Government Initiatives and Support

Government initiatives aimed at promoting digitalization and technology adoption are significantly influencing the infrastructure as-a-service market in India. Programs such as Digital India and Make in India are designed to enhance the country's technological capabilities and infrastructure. These initiatives encourage businesses to adopt cloud solutions, thereby driving the demand for infrastructure as-a-service offerings. The Indian government has also been investing in data centers and cloud infrastructure, which is expected to bolster the market further. With the government's focus on improving internet connectivity and digital literacy, the infrastructure as-a-service market is poised for substantial growth. As a result, businesses are likely to leverage these government-backed initiatives to enhance their IT capabilities and streamline operations, contributing to the overall expansion of the market.

Increased Focus on Cost Efficiency

Cost efficiency remains a critical driver for the infrastructure as-a-service market in India. Organizations are increasingly seeking ways to minimize operational expenses while maximizing productivity. By adopting infrastructure as-a-service solutions, companies can avoid the high capital expenditures associated with traditional IT infrastructure. This model allows businesses to pay only for the resources they use, which can lead to significant savings. Recent studies indicate that companies can reduce their IT costs by up to 30% by migrating to cloud-based services. As more organizations recognize the financial benefits of this model, the infrastructure as-a-service market is likely to experience accelerated growth. Additionally, the ability to scale resources up or down based on demand further enhances cost efficiency, making this market an attractive option for businesses across various sectors.

Emergence of Startups and Innovation

The emergence of startups and innovation in the technology sector is a significant driver for the infrastructure as-a-service market in India. Startups are increasingly adopting cloud-based solutions to accelerate their growth and enhance their operational capabilities. The flexibility and scalability offered by infrastructure as-a-service solutions allow these new businesses to focus on innovation without the burden of managing physical infrastructure. Furthermore, the Indian startup ecosystem is thriving, with over 50 unicorns emerging in recent years. This trend indicates a growing reliance on cloud technologies, which is likely to propel the infrastructure as-a-service market forward. As startups continue to seek agile and cost-effective solutions, the demand for infrastructure as-a-service offerings is expected to rise, fostering a dynamic environment for technological advancement.

Growing Adoption of Cloud Technologies

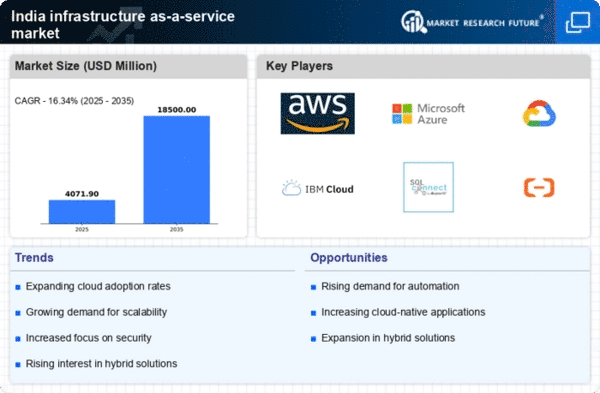

The increasing adoption of cloud technologies in India is a primary driver for the infrastructure as-a-service market. Organizations are transitioning from traditional IT setups to cloud-based solutions to enhance operational efficiency and reduce costs. According to recent data, the cloud computing market in India is projected to reach $10 billion by 2025, indicating a robust growth trajectory. This shift is largely attributed to the need for scalable resources and the flexibility that cloud services offer. As businesses seek to optimize their IT infrastructure, This trend is likely to benefit significantly. Furthermore, the rise of remote work and digital transformation initiatives across various sectors is propelling the demand for cloud-based services, thereby reinforcing the infrastructure as-a-service market's position in the Indian economy.

Rising Data Generation and Storage Needs

The exponential growth of data generation in India is driving the infrastructure as-a-service market. With the proliferation of IoT devices, social media, and digital transactions, organizations are faced with the challenge of managing vast amounts of data. This surge in data necessitates robust storage solutions, which infrastructure as-a-service providers can offer. The market is expected to grow as businesses seek scalable and flexible storage options to accommodate their data needs. According to estimates, data generation in India is projected to reach 175 zettabytes by 2025, highlighting the urgent need for efficient data management solutions. Consequently, the infrastructure as-a-service market is likely to thrive as organizations look for ways to leverage cloud technologies to store, analyze, and secure their data effectively.