Emergence of Edge Computing

The emergence of edge computing is reshaping the Infrastructure-as-a-service Market. As the Internet of Things (IoT) continues to proliferate, the need for processing data closer to the source becomes increasingly apparent. Edge computing facilitates real-time data analysis and reduces latency, which is essential for applications such as autonomous vehicles and smart cities. IaaS providers are adapting their offerings to incorporate edge capabilities, allowing businesses to deploy resources at the edge of their networks. This shift not only enhances performance but also optimizes bandwidth usage. Industry forecasts indicate that the edge computing market could reach a valuation of over 15 billion dollars by 2026, further solidifying the Infrastructure-as-a-service Market's relevance in a rapidly evolving technological landscape.

Growing Demand for Scalability

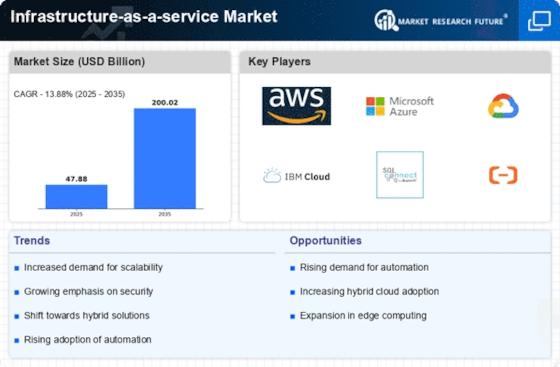

The Infrastructure-as-a-service Market experiences a notable surge in demand for scalable solutions. Organizations increasingly seek the ability to adjust their IT resources dynamically, responding to fluctuating workloads and business needs. This trend is particularly pronounced among small to medium-sized enterprises, which often lack the capital for extensive on-premises infrastructure. According to recent data, the IaaS market is projected to grow at a compound annual growth rate of approximately 25% over the next five years. This growth is driven by the need for flexibility and cost efficiency, allowing businesses to pay only for the resources they utilize. As companies expand their operations, the ability to scale infrastructure seamlessly becomes a critical factor in their strategic planning, thereby propelling the Infrastructure-as-a-service Market forward.

Cost Efficiency and Budget Management

Cost efficiency remains a pivotal driver within the Infrastructure-as-a-service Market. Organizations are increasingly drawn to IaaS solutions due to their potential for reducing capital expenditures associated with traditional IT infrastructure. By leveraging IaaS, companies can convert fixed costs into variable costs, allowing for more predictable budgeting and financial planning. Recent analyses indicate that businesses can save up to 30% on IT costs by adopting IaaS solutions. This financial advantage is particularly appealing in competitive markets where operational efficiency is paramount. Furthermore, the pay-as-you-go model inherent in IaaS offerings enables organizations to allocate resources more effectively, ensuring that they only invest in what they need. As a result, the Infrastructure-as-a-service Market continues to attract a diverse range of enterprises seeking to optimize their financial performance.

Regulatory Compliance and Data Sovereignty

Regulatory compliance and data sovereignty are becoming critical considerations within the Infrastructure-as-a-service Market. As data protection regulations tighten across various jurisdictions, organizations must ensure that their IaaS solutions comply with local laws regarding data storage and processing. This necessity is particularly pronounced in sectors such as finance and healthcare, where data privacy is paramount. IaaS providers are increasingly offering solutions that address these compliance challenges, enabling businesses to navigate the complex regulatory landscape effectively. Recent surveys indicate that nearly 70% of organizations view compliance as a top priority when selecting an IaaS provider. This focus on regulatory adherence is likely to drive further innovation and specialization within the Infrastructure-as-a-service Market, as providers seek to differentiate themselves in a competitive environment.

Increased Focus on Disaster Recovery Solutions

The Infrastructure-as-a-service Market is witnessing an increased emphasis on disaster recovery solutions. Organizations recognize the critical importance of maintaining business continuity in the face of unforeseen disruptions. IaaS providers are responding by offering robust disaster recovery services that ensure data integrity and availability. Recent statistics suggest that nearly 60% of businesses that experience a significant data loss cease operations within six months. This alarming trend underscores the necessity for reliable backup and recovery options. By utilizing IaaS for disaster recovery, companies can implement comprehensive strategies that minimize downtime and safeguard their operations. The growing awareness of these risks is likely to drive further investment in IaaS solutions, reinforcing the Infrastructure-as-a-service Market's role in enhancing organizational resilience.