Rising Healthcare Expenditure

Rising healthcare expenditure in India is another key driver for the influenza diagnostics market. As the country experiences economic growth, there is a corresponding increase in healthcare spending by both the government and private sectors. This trend is reflected in the allocation of funds for healthcare infrastructure, including diagnostic facilities. According to recent reports, healthcare expenditure in India is projected to reach approximately 3.5% of GDP by 2025. This increase is likely to enhance the accessibility and affordability of diagnostic services, thereby stimulating demand for influenza diagnostics. As healthcare systems evolve, the market is expected to benefit from improved diagnostic capabilities and expanded service offerings.

Government Funding and Support

Government funding and support for healthcare initiatives play a crucial role in the growth of the influenza diagnostics market. The Indian government has been actively promoting public health programs aimed at improving disease surveillance and response capabilities. For instance, the National Health Mission allocates substantial resources for the development and distribution of diagnostic tools. This financial backing not only enhances the availability of influenza diagnostics but also encourages research and development in this field. As a result, the market is likely to witness an influx of innovative diagnostic solutions, further propelling its expansion in the coming years.

Rising Incidence of Influenza Cases

The increasing incidence of influenza cases in India is a primary driver for the influenza diagnostics market. Seasonal outbreaks and sporadic epidemics contribute to a heightened demand for accurate and timely diagnostic solutions. According to the Ministry of Health and Family Welfare, influenza cases have shown a notable rise, with estimates suggesting that around 10-15% of the population may be affected during peak seasons. This surge necessitates the availability of effective diagnostic tools to facilitate early detection and treatment, thereby driving growth in the influenza diagnostics market. Healthcare providers are increasingly investing in advanced diagnostic technologies to meet this demand, indicating a robust market potential.

Increased Focus on Preventive Healthcare

The growing focus on preventive healthcare is a significant driver for the influenza diagnostics market in India. With rising awareness about the importance of early detection and prevention of infectious diseases, individuals are increasingly seeking diagnostic services. Public health campaigns and educational initiatives have contributed to a shift in consumer behavior, leading to higher demand for influenza testing. This trend is likely to continue, as more people recognize the value of proactive health management. Consequently, healthcare providers are expanding their diagnostic offerings, which is expected to positively impact the influenza diagnostics market in the near future.

Technological Innovations in Diagnostic Tools

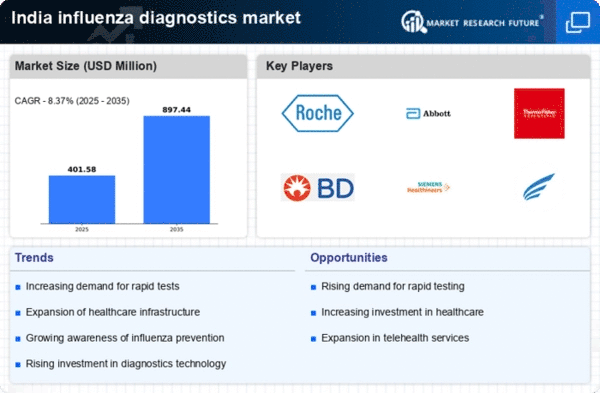

Technological innovations in diagnostic tools are significantly influencing the influenza diagnostics market. The introduction of rapid diagnostic tests, molecular assays, and point-of-care testing devices has transformed the landscape of influenza detection. These advancements enable healthcare professionals to obtain results within a short timeframe, which is critical for effective patient management. The market is projected to grow at a CAGR of approximately 8-10% from 2025 to 2035, driven by the increasing adoption of these technologies. As healthcare facilities in India strive to enhance their diagnostic capabilities, the demand for innovative solutions is expected to rise, thereby fostering market growth.