Rising Demand for Automation

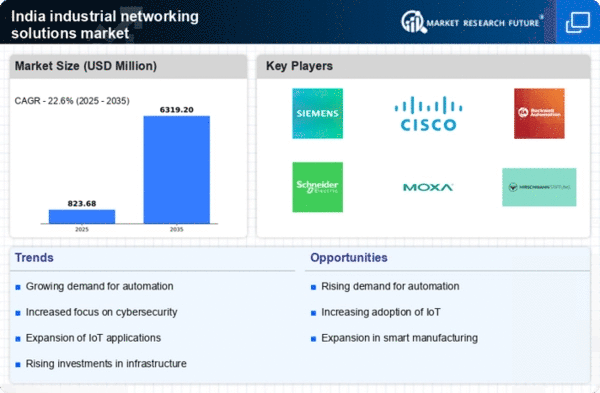

The industrial networking-solutions market in India experiences a notable surge in demand for automation across various sectors. Industries are increasingly adopting automated processes to enhance efficiency and reduce operational costs. According to recent data, the automation market in India is projected to grow at a CAGR of approximately 10% from 2025 to 2030. This trend is driven by the need for improved productivity and the ability to respond swiftly to market changes. As companies seek to integrate advanced networking solutions, the industrial networking-solutions market is expected to benefit significantly from this shift towards automation, enabling seamless communication between devices and systems.

Growing Focus on Data Analytics

The industrial networking-solutions market in India is witnessing a growing emphasis on data analytics as industries strive to harness the power of big data. Companies are increasingly recognizing the value of data-driven decision-making, which necessitates robust networking solutions to facilitate real-time data collection and analysis. The analytics market in India is projected to grow at a CAGR of around 28% from 2025 to 2030, indicating a strong demand for networking solutions that support data analytics capabilities. This trend is likely to propel the industrial networking-solutions market, as businesses seek to optimize operations and enhance competitiveness through informed insights.

Expansion of Smart Manufacturing

The push towards smart manufacturing is a critical driver for the industrial networking-solutions market in India. With the government promoting initiatives like 'Make in India', manufacturers are increasingly investing in smart technologies. This transition is expected to enhance operational efficiency and product quality. Reports indicate that the smart manufacturing market in India is anticipated to reach $20 billion by 2025, reflecting a robust growth trajectory. As manufacturers adopt IoT and AI technologies, the demand for reliable networking solutions will likely escalate, positioning the industrial networking-solutions market as a key enabler of this transformation.

Government Initiatives and Policies

Government initiatives play a pivotal role in shaping the industrial networking-solutions market in India. Policies aimed at enhancing digital infrastructure and promoting Industry 4.0 are fostering an environment conducive to technological advancements. The Digital India initiative, for instance, aims to transform India into a digitally empowered society and knowledge economy. This initiative is expected to drive investments in networking solutions, as industries seek to comply with new standards and leverage digital technologies. The industrial networking-solutions market is likely to see increased growth as businesses align with government policies that encourage modernization and connectivity.

Increased Connectivity Requirements

As industries in India evolve, the need for enhanced connectivity becomes increasingly apparent. The rise of interconnected devices and systems necessitates advanced networking solutions to ensure seamless communication. The industrial networking-solutions market is likely to benefit from this trend, as companies seek to implement reliable and scalable networking infrastructures. With the proliferation of IoT devices, the demand for high-speed and secure networking solutions is expected to grow significantly. This increased connectivity requirement is poised to drive innovation within the industrial networking-solutions market, as businesses strive to maintain operational efficiency and competitiveness in a rapidly changing landscape.