Need for Enhanced Data Analytics

The industrial ai market in India is being driven by the increasing need for enhanced data analytics capabilities. As organizations generate vast amounts of data, the ability to analyze and derive actionable insights becomes paramount. AI technologies are being utilized to process and interpret complex datasets, enabling businesses to make informed decisions. This trend is particularly relevant in sectors such as manufacturing and logistics, where data-driven strategies can lead to significant cost savings and improved operational performance. The demand for advanced analytics solutions is expected to grow, further propelling the industrial ai market as companies seek to harness the power of their data.

Government Initiatives and Support

The Indian government is actively promoting the adoption of AI technologies across various sectors, which significantly impacts the industrial ai market. Initiatives such as the National AI Strategy aim to position India as a leader in AI innovation. Financial incentives, grants, and policy frameworks are being established to encourage businesses to integrate AI into their operations. This governmental support is expected to catalyze growth in the industrial ai market, with projections indicating a potential increase in market size by over 25% in the coming years. Such initiatives not only enhance technological capabilities but also create a conducive environment for startups and established firms alike.

Focus on Workforce Skill Development

the industrial AI market in India is influenced by the growing emphasis on workforce skill development. As AI technologies become more prevalent, there is a pressing need for skilled professionals who can effectively implement and manage these systems. Educational institutions and corporate training programs are increasingly focusing on AI and machine learning, aiming to equip the workforce with the necessary skills. This focus on skill development is likely to enhance the adoption of AI technologies in industries, thereby driving growth in the industrial ai market. A well-trained workforce can facilitate smoother transitions to AI-driven operations, ultimately benefiting organizations and the economy as a whole.

Rising Demand for Operational Efficiency

the industrial AI market in India is seeing a notable surge in demand for operational efficiency. Companies are increasingly adopting AI-driven solutions to streamline processes, reduce waste, and enhance productivity. According to recent estimates, the integration of AI technologies can lead to efficiency improvements of up to 30%. This trend is particularly evident in manufacturing sectors, where automation and data analytics are being leveraged to optimize supply chains and production lines. As organizations strive to remain competitive, the focus on operational efficiency is likely to drive investments in the industrial ai market, fostering innovation and technological advancements.

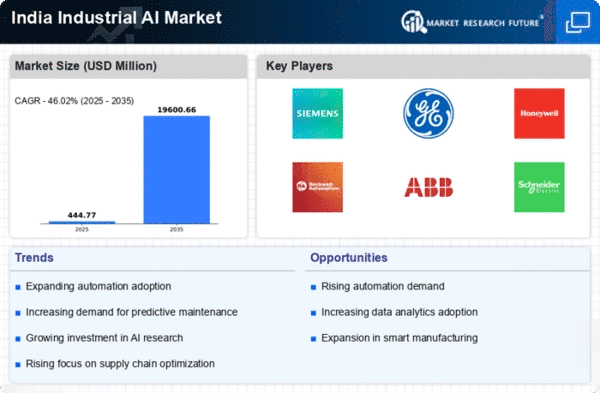

Growing Investment in Smart Manufacturing

Investment in smart manufacturing technologies is a key driver for the industrial ai market in India. As industries transition towards Industry 4.0, the integration of AI, IoT, and big data analytics is becoming essential. Reports suggest that the smart manufacturing sector in India is projected to reach a valuation of $200 billion by 2025, with AI playing a crucial role in this transformation. Companies are increasingly recognizing the potential of AI to enhance production efficiency, reduce downtime, and improve product quality. This growing investment is likely to propel the industrial ai market forward, fostering a culture of innovation and technological advancement.