Rising Automation in Manufacturing

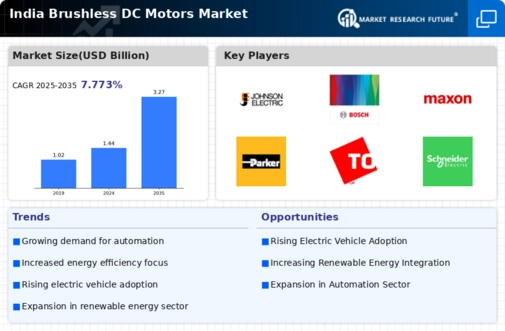

The increasing trend towards automation in manufacturing processes is a key driver for the brushless dc-motors market. Industries are adopting advanced technologies to enhance productivity and efficiency. Brushless dc-motors, known for their reliability and precision, are becoming integral to automated systems. In India, the manufacturing sector is projected to grow at a CAGR of 10% from 2023 to 2028, which could significantly boost the demand for these motors. As companies seek to optimize operations, the brushless dc-motors market is likely to benefit from this shift towards automation, providing solutions that meet the evolving needs of modern manufacturing.

Expansion of Renewable Energy Sources

The push for renewable energy sources in India is driving the brushless dc-motors market. With the government's commitment to increasing the share of renewables in the energy mix, there is a growing need for efficient motor solutions in wind and solar applications. Brushless dc-motors are favored for their high efficiency and low maintenance requirements, making them suitable for renewable energy systems. The Indian renewable energy sector is expected to attract investments exceeding $20 billion by 2025, which may lead to a surge in demand for brushless dc-motors as they play a crucial role in energy conversion and management.

Advancements in Electric Mobility Solutions

The shift towards electric mobility in India is a significant driver for the brushless dc-motors market. As the government promotes electric vehicles (EVs) through various incentives, the demand for efficient and reliable motors is increasing. Brushless dc-motors are preferred in EV applications due to their high torque and efficiency. The Indian EV market is anticipated to grow at a CAGR of 36% from 2023 to 2030, which could substantially elevate the demand for brushless dc-motors. This trend indicates a robust future for the brushless dc-motors market as it aligns with the broader goals of sustainable transportation.

Government Initiatives for Industrial Growth

Government initiatives aimed at boosting industrial growth in India are positively impacting the brushless dc-motors market. Programs such as 'Make in India' and 'Atmanirbhar Bharat' encourage local manufacturing and innovation. These initiatives are likely to enhance the demand for advanced motor technologies, including brushless dc-motors, as industries seek to modernize their operations. The Indian manufacturing sector is expected to contribute 25% to the GDP by 2025, which may lead to increased investments in automation and motor technologies. This environment presents a favorable outlook for the brushless dc-motors market as it aligns with national growth objectives.

Increased Focus on Automation in Home Appliances

The growing trend of automation in home appliances is influencing the brushless dc-motors market. As consumers seek smart and energy-efficient solutions, manufacturers are integrating brushless dc-motors into various appliances such as washing machines, refrigerators, and HVAC systems. These motors offer advantages like reduced noise and improved energy efficiency. The home appliance market in India is projected to reach $15 billion by 2025, suggesting a potential increase in the adoption of brushless dc-motors. This trend reflects a shift towards modern living, where convenience and efficiency are paramount.