Growing Automotive Sector

The automotive industry in India is a significant driver for the hot dip galvanizing market. With the increasing production of vehicles, there is a rising need for corrosion-resistant components. The Indian automotive sector is projected to reach USD 300 billion by 2026, which could lead to a heightened demand for galvanized parts. Hot dip galvanizing provides essential protection for automotive components, enhancing their lifespan and performance. Additionally, as manufacturers focus on improving vehicle safety and durability, the adoption of galvanized materials is likely to increase. This trend indicates a promising future for the hot dip galvanizing market, as automotive manufacturers seek reliable solutions to meet stringent quality standards.

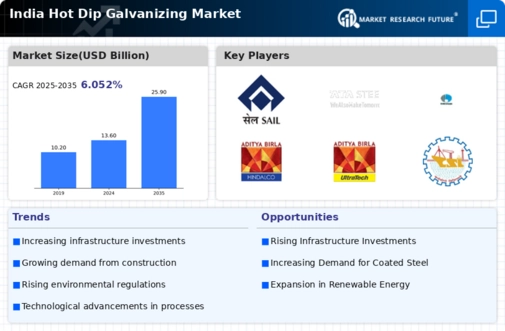

Rising Infrastructure Investments

The India hot dip galvanizing market is experiencing a notable surge due to increased investments in infrastructure development. The government has allocated substantial funds for projects such as roads, bridges, and urban development, which require durable materials. For instance, the National Infrastructure Pipeline aims to invest over USD 1.4 trillion by 2025, creating a robust demand for galvanized steel. This trend is likely to bolster the hot dip galvanizing market, as galvanized steel is preferred for its corrosion resistance and longevity, essential for infrastructure longevity. Furthermore, the push for smart cities and urban renewal projects is expected to further drive the demand for hot dip galvanizing, as these projects often prioritize sustainable and durable construction materials.

Government Regulations and Standards

The India hot dip galvanizing market is significantly influenced by government regulations aimed at enhancing material quality and safety. The Bureau of Indian Standards has established guidelines that promote the use of galvanized steel in various applications, particularly in construction and infrastructure. These regulations not only ensure safety but also encourage the adoption of hot dip galvanizing as a preferred method for corrosion protection. Furthermore, initiatives such as the Make in India campaign advocate for the use of domestically produced materials, which may lead to increased demand for local hot dip galvanizing services. As compliance with these standards becomes mandatory, the market is likely to witness a surge in demand for galvanized products.

Increased Awareness of Corrosion Protection

There is a growing awareness among industries regarding the importance of corrosion protection, which is a key driver for the hot dip galvanizing market in India. Industries such as construction, manufacturing, and energy are increasingly recognizing the long-term cost benefits of using galvanized materials. Corrosion can lead to significant financial losses, prompting companies to invest in protective measures. The hot dip galvanizing process offers a reliable solution, extending the lifespan of steel structures and components. As awareness campaigns and educational initiatives proliferate, more businesses are likely to adopt hot dip galvanizing as a standard practice, thereby expanding the market. This trend suggests a positive outlook for the industry as it aligns with the growing emphasis on sustainability and cost-effectiveness.

Technological Innovations in Galvanizing Processes

Technological advancements in the hot dip galvanizing market are playing a crucial role in enhancing efficiency and product quality. Innovations such as automated galvanizing lines and improved coating techniques are enabling manufacturers to produce higher quality galvanized products at a lower cost. These advancements not only reduce production time but also minimize waste, aligning with sustainability goals. Moreover, the introduction of advanced monitoring systems allows for better quality control during the galvanizing process. As industries increasingly seek efficient and eco-friendly solutions, the adoption of these technologies is likely to drive growth in the hot dip galvanizing market. The potential for improved performance and reduced environmental impact positions the industry favorably in the competitive landscape.