Growing Pharmaceutical Sector

India's pharmaceutical industry is one of the largest in the world, contributing significantly to the high throughput-screening market. The sector is projected to reach $65 B by 2024, driven by increasing demand for generic drugs and innovative therapies. This growth is likely to stimulate the need for efficient drug discovery processes, where high throughput screening plays a crucial role. Pharmaceutical companies are increasingly adopting these technologies to accelerate the identification of potential drug candidates, thereby reducing time-to-market. The integration of high throughput screening in research and development processes is expected to enhance productivity and efficiency, making it a vital component of the pharmaceutical landscape in India.

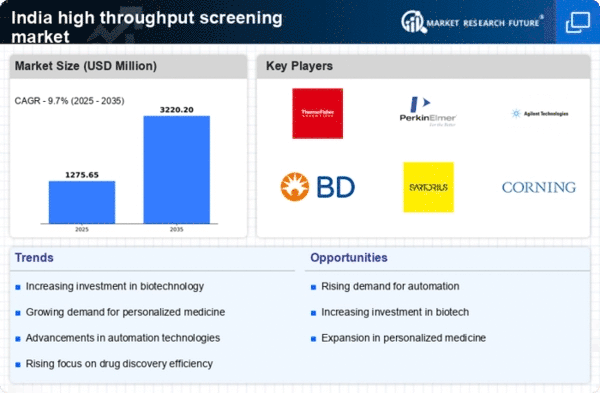

Increased Investment in Biotechnology

The high throughput-screening market in India is experiencing a surge in investment from both public and private sectors. Government initiatives aimed at boosting biotechnology research and development are likely to enhance the capabilities of screening technologies. For instance, the Indian government has allocated substantial funds to support biotechnology startups, which may lead to innovative solutions in drug discovery. This influx of capital is expected to drive the adoption of high throughput screening methods, as companies seek to optimize their research processes. Furthermore, the biotechnology sector in India is projected to reach $100 B by 2025, indicating a robust growth trajectory that will likely benefit the high throughput-screening market. As investment continues to grow, the market is poised for significant advancements in technology and methodology.

Emergence of Startups in Life Sciences

The high throughput-screening market is witnessing a rise in the number of startups focused on life sciences and biotechnology in India. These startups are often at the forefront of innovation, developing cutting-edge technologies that enhance screening processes. The entrepreneurial ecosystem in India is becoming increasingly supportive, with incubators and accelerators providing resources and mentorship to emerging companies. This trend is likely to foster the development of novel high throughput screening solutions tailored to the specific needs of the Indian market. As these startups gain traction, they may contribute to the overall growth of the high throughput-screening market by introducing disruptive technologies and methodologies.

Rising Focus on Research and Development

The emphasis on research and development (R&D) in India is a key driver for the high throughput-screening market. With a growing number of research institutions and universities focusing on life sciences, the demand for advanced screening technologies is likely to increase. The Indian government has recognized the importance of R&D in driving innovation and has implemented policies to support scientific research. This includes funding for collaborative projects between academia and industry, which may lead to the development of novel high throughput screening applications. As R&D activities expand, the high throughput-screening market is expected to benefit from increased adoption of these technologies in various research initiatives.

Increasing Collaborations Between Industry and Academia

Collaborations between industry and academic institutions are becoming more prevalent in India, significantly impacting the high throughput-screening market. These partnerships facilitate the exchange of knowledge and resources, leading to advancements in screening technologies. Academic institutions often possess cutting-edge research capabilities, while industries provide practical applications and funding. This synergy is likely to accelerate the development of innovative high throughput screening methods, enhancing the efficiency of drug discovery processes. As more collaborations emerge, the high throughput-screening market is expected to expand, driven by the combined expertise of both sectors.