Increased Focus on Drug Repurposing

The high throughput-screening market in Germany is witnessing an increased focus on drug repurposing as a viable strategy for accelerating drug development. This approach allows researchers to identify new therapeutic uses for existing drugs, thereby reducing the time and cost associated with bringing new treatments to market. In 2025, it is projected that the drug repurposing market will grow by approximately 15%, driven by the need for rapid solutions in therapeutic areas with unmet needs. High throughput screening technologies play a pivotal role in this process by enabling the efficient evaluation of existing compounds against new targets. As pharmaceutical companies and research institutions in Germany embrace this strategy, the demand for high throughput screening solutions is expected to rise, fostering innovation and collaboration within the industry.

Strengthening Regulatory Frameworks

The high throughput-screening market is also influenced by the strengthening of regulatory frameworks in Germany. Regulatory bodies are increasingly recognizing the importance of high throughput screening technologies in ensuring the safety and efficacy of new drugs. In 2025, it is anticipated that new guidelines will be established to streamline the approval process for screening methods, thereby facilitating their adoption in research and development. This regulatory support is likely to enhance the credibility of high throughput screening solutions, encouraging more companies to invest in these technologies. Furthermore, as regulatory requirements evolve, there may be a growing emphasis on the validation of screening methods, which could lead to the development of standardized protocols. Such advancements are expected to bolster the high throughput-screening market, as companies seek to comply with new regulations while maintaining competitive advantages.

Growing Demand for Targeted Therapies

The high throughput-screening market is being propelled by the growing demand for targeted therapies in Germany. As the healthcare landscape shifts towards personalized medicine, there is an increasing need for screening technologies that can identify specific biomarkers associated with diseases. This trend is particularly evident in oncology, where targeted therapies are becoming the standard of care. In 2025, it is estimated that the market for targeted therapies will reach €10 billion, creating a substantial opportunity for high throughput screening solutions that can facilitate the identification of suitable candidates for these therapies. The ability to rapidly screen large libraries of compounds against specific targets is crucial for the development of effective treatments. Consequently, the high throughput-screening market is likely to benefit from this shift, as pharmaceutical companies seek to enhance their drug discovery processes to meet the demands of precision medicine.

Rising Investment in Biopharmaceutical Research

Germany's high throughput-screening market is significantly influenced by the rising investment in biopharmaceutical research. The country has established itself as a hub for pharmaceutical innovation, with government initiatives and private sector funding contributing to a robust research environment. In 2025, biopharmaceutical companies are expected to allocate over €5 billion towards research and development, with a substantial portion directed towards high throughput screening technologies. This influx of capital is likely to enhance the capabilities of research facilities, enabling them to conduct more extensive and sophisticated screening processes. As a result, the demand for high throughput-screening solutions is anticipated to increase, further propelling market growth. The collaboration between academia and industry in Germany is also fostering innovation, leading to the development of novel screening methodologies that could revolutionize drug discovery.

Technological Advancements in Screening Methods

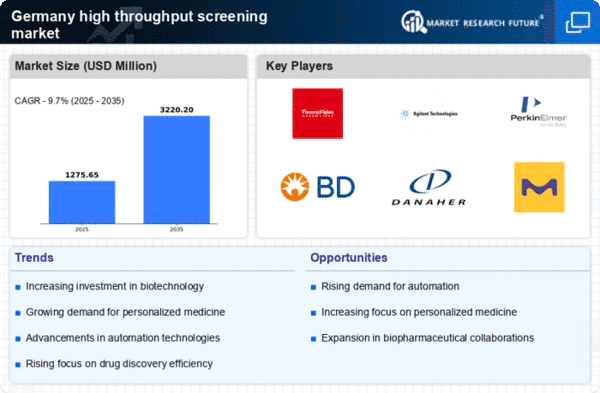

The high throughput-screening market in Germany is experiencing a surge due to rapid technological advancements in screening methods. Innovations such as microfluidics and lab-on-a-chip technologies are enhancing the efficiency and accuracy of drug discovery processes. These advancements allow for the simultaneous analysis of thousands of compounds, significantly reducing the time required for research and development. In 2025, the market is projected to grow at a CAGR of approximately 10%, driven by the increasing demand for faster and more reliable screening techniques. Furthermore, the integration of artificial intelligence in data analysis is expected to streamline workflows, making it easier for researchers to identify potential drug candidates. This technological evolution is likely to position Germany as a leader in the high throughput-screening market, attracting investments and fostering collaborations among biotech firms and research institutions.