Rising Healthcare Expenditure

The increase in healthcare expenditure in India is a significant driver for the heart failure-drugs market. Government initiatives aimed at improving healthcare access and quality have led to a rise in public and private spending on health services. Reports indicate that healthcare expenditure as a share of GDP has risen to about 3.5%, reflecting a growing commitment to addressing chronic diseases like heart failure. This financial support enables better access to advanced medications and treatments for patients. As healthcare systems evolve, the heart failure-drugs market is likely to benefit from increased funding for research, development, and distribution of heart failure therapies, potentially leading to a more robust market environment.

Growing Awareness and Education

Increasing awareness and education regarding heart failure among healthcare professionals and the general public are pivotal for the heart failure-drugs market. Campaigns aimed at educating patients about the symptoms and management of heart failure are gaining traction, leading to earlier diagnosis and treatment. Healthcare providers are also receiving enhanced training on the latest treatment protocols, which may improve patient outcomes. This heightened awareness is likely to drive demand for heart failure medications, as more individuals seek treatment. As a result, the heart failure-drugs market may experience a surge in growth, with estimates suggesting a potential increase in market size by 15% over the next few years.

Advancements in Drug Development

Technological advancements in drug development are reshaping the heart failure-drugs market. The introduction of novel drug delivery systems and biologics has the potential to enhance treatment efficacy and patient compliance. For instance, recent innovations in sustained-release formulations allow for less frequent dosing, which may improve adherence among patients. Furthermore, the integration of artificial intelligence in drug discovery processes is streamlining the identification of new therapeutic targets. As a result, pharmaceutical companies are likely to invest heavily in research and development, aiming to bring more effective heart failure treatments to market. This focus on innovation is expected to drive growth in the heart failure-drugs market, with an anticipated increase in market value reaching approximately $2 billion by 2027.

Supportive Regulatory Environment

A supportive regulatory environment in India is fostering growth in the heart failure-drugs market. The government has implemented policies aimed at expediting the approval process for new drugs, which encourages pharmaceutical companies to invest in research and development. Initiatives such as the Fast Track Approval process for critical medications are designed to bring innovative therapies to market more swiftly. This regulatory support not only enhances the availability of new heart failure treatments but also stimulates competition among manufacturers. As a result, the heart failure-drugs market is likely to see an influx of novel therapies, contributing to a more diverse and effective treatment landscape for patients.

Growing Prevalence of Heart Failure

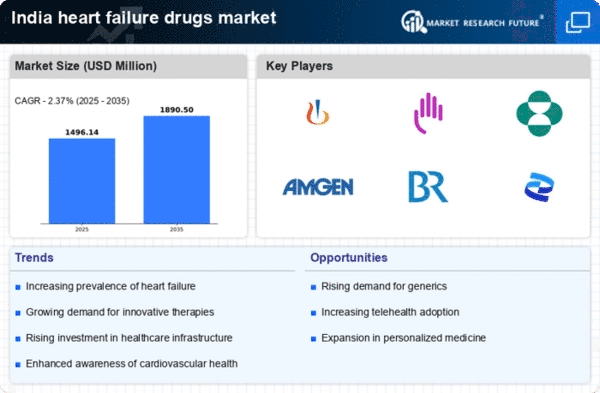

The increasing incidence of heart failure in India is a primary driver for the heart failure-drugs market. Recent studies indicate that approximately 1.3 million individuals are diagnosed with heart failure annually in the country. This rising prevalence is attributed to factors such as urbanization, lifestyle changes, and an aging population. As the number of patients grows, the demand for effective heart failure therapies intensifies. Consequently, pharmaceutical companies are focusing on developing innovative drugs to address this urgent health issue. The heart failure-drugs market is expected to expand significantly, with projections suggesting a compound annual growth rate (CAGR) of around 10% over the next five years. This trend underscores the necessity for ongoing research and development in the sector to meet the needs of a growing patient population.