Aging Population

The aging population is a significant factor driving the Heart Failure Drugs Market. As life expectancy increases, the proportion of older adults in the population rises, leading to a higher incidence of heart failure. Older adults are more susceptible to cardiovascular diseases, which are often precursors to heart failure. This demographic shift is expected to result in a substantial increase in the demand for heart failure drugs. By 2030, it is projected that the number of individuals aged 65 and older will reach 1.5 billion, further intensifying the need for effective treatment options. Pharmaceutical companies are likely to focus on developing age-appropriate formulations and therapies that cater to the unique needs of this population, thereby enhancing market growth prospects.

Advancements in Drug Development

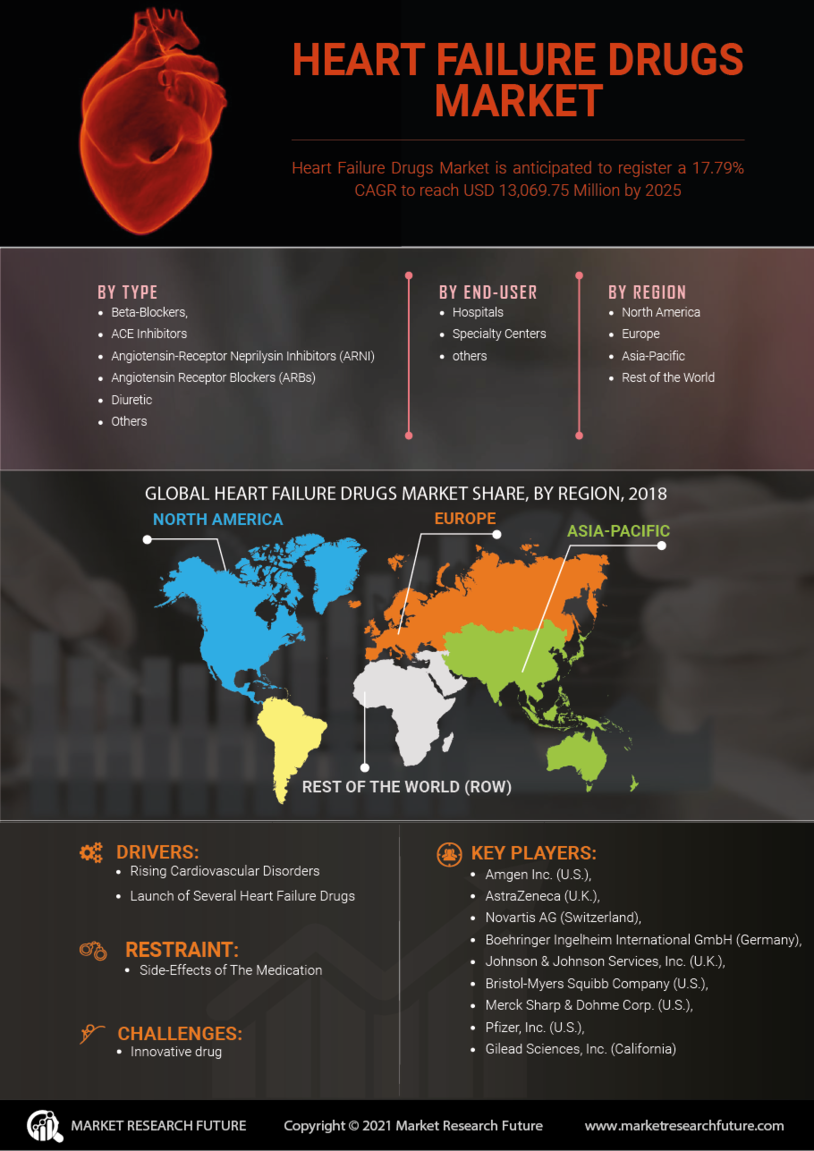

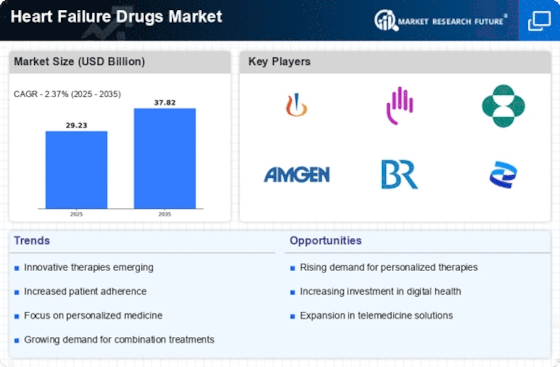

Innovations in drug development are significantly influencing the Heart Failure Drugs Market. Recent advancements in pharmacotherapy, including the introduction of novel agents such as SGLT2 inhibitors and ARNI (Angiotensin Receptor Neprilysin Inhibitors), have transformed treatment paradigms. These drugs not only improve survival rates but also enhance the quality of life for patients suffering from heart failure. The market for heart failure drugs is projected to reach USD 30 billion by 2026, driven by these advancements. Furthermore, ongoing clinical trials and research are likely to yield new therapies that could address unmet medical needs, thereby expanding the market. The continuous evolution of treatment options is expected to attract investment and foster competition among pharmaceutical companies, further stimulating market growth.

Increased Awareness and Education

Growing awareness and education regarding heart failure are crucial drivers for the Heart Failure Drugs Market. Healthcare campaigns aimed at educating both patients and healthcare professionals about the symptoms and management of heart failure have led to earlier diagnosis and treatment. This heightened awareness is likely to result in increased patient engagement and adherence to prescribed therapies. As patients become more informed about their condition, the demand for effective heart failure drugs is expected to rise. Additionally, healthcare providers are increasingly recognizing the importance of comprehensive management strategies, which include pharmacological interventions. This trend is anticipated to contribute to a more robust market for heart failure drugs, as more patients seek treatment options that can help manage their condition effectively.

Rising Prevalence of Heart Failure

The increasing incidence of heart failure is a primary driver for the Heart Failure Drugs Market. As populations age, the prevalence of chronic conditions such as hypertension and diabetes rises, leading to a higher number of heart failure cases. According to recent estimates, heart failure affects approximately 26 million people worldwide, and this number is expected to grow. This surge in patient numbers necessitates the development and availability of effective heart failure drugs, thereby propelling market growth. Pharmaceutical companies are investing significantly in research and development to create innovative therapies that can manage heart failure more effectively. The demand for these drugs is likely to continue increasing as healthcare providers seek to improve patient outcomes and reduce hospitalizations associated with heart failure.

Regulatory Support and Reimbursement Policies

Supportive regulatory frameworks and favorable reimbursement policies are vital drivers for the Heart Failure Drugs Market. Governments and health authorities are increasingly recognizing the burden of heart failure on healthcare systems and are implementing policies to facilitate access to innovative therapies. This includes expedited approval processes for new drugs and favorable reimbursement rates for heart failure treatments. Such measures are likely to encourage pharmaceutical companies to invest in research and development, knowing that their products will have a pathway to market. Additionally, improved reimbursement policies can enhance patient access to essential medications, thereby driving demand. As a result, the Heart Failure Drugs Market is expected to benefit from these supportive measures, leading to increased availability of effective treatment options.