Expansion of Telehealth Services

The expansion of telehealth services in India is driving growth in the healthcare analytics market. As more patients opt for remote consultations, the volume of data generated through telehealth platforms is increasing. This data presents a unique opportunity for healthcare providers to leverage analytics for improved service delivery. The healthcare analytics market industry is likely to see a rise in demand for analytics solutions that can process and analyze telehealth data effectively. By harnessing insights from telehealth interactions, providers can enhance their understanding of patient needs and optimize their services accordingly, thereby improving overall healthcare delivery.

Government Initiatives and Support

Government initiatives aimed at enhancing healthcare infrastructure in India are significantly impacting the healthcare analytics market. Programs promoting digital health and the adoption of electronic health records (EHRs) are fostering an environment conducive to analytics. The Indian government has allocated substantial funding to improve healthcare services, which includes investments in technology and data analytics. This support is likely to accelerate the adoption of analytics solutions among healthcare providers. As a result, the healthcare analytics market industry is expected to benefit from increased funding and resources, enabling the development of innovative analytics tools tailored to the unique needs of the Indian healthcare system.

Growing Focus on Patient-Centric Care

The shift towards patient-centric care is reshaping the healthcare analytics market in India. Providers are increasingly utilizing analytics to understand patient needs and preferences, thereby enhancing the overall patient experience. This trend is reflected in the growing investment in analytics solutions that facilitate personalized treatment plans and improve patient engagement. The healthcare analytics market industry is likely to see a rise in demand for tools that enable real-time patient feedback and outcome tracking. As healthcare organizations strive to deliver tailored services, the integration of analytics into patient care strategies becomes crucial, potentially leading to better health outcomes and increased patient satisfaction.

Integration of Wearable Health Technologies

The integration of wearable health technologies is emerging as a key driver for the healthcare analytics market in India. With the proliferation of devices that monitor health metrics, there is a growing need for analytics to interpret the data generated by these wearables. This trend is indicative of a broader shift towards proactive health management, where individuals and healthcare providers utilize data to make informed decisions. The healthcare analytics market industry is poised to benefit from the increasing adoption of wearables, as analytics solutions become essential for translating raw data into actionable health insights. This integration could lead to improved health outcomes and a more engaged patient population.

Rising Demand for Data-Driven Decision Making

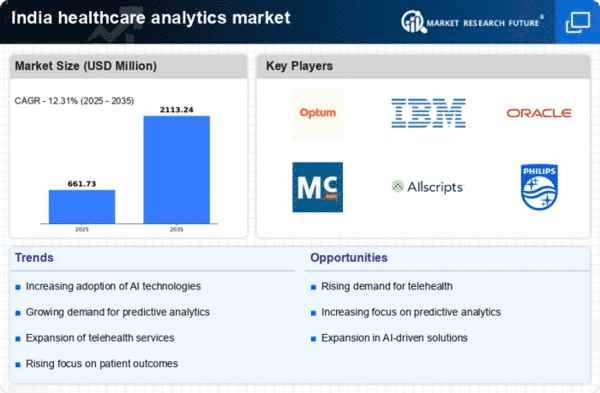

The healthcare analytics market in India is experiencing a notable surge in demand for data-driven decision making. Healthcare providers are increasingly recognizing the value of analytics in improving patient outcomes and operational efficiency. According to recent estimates, the market is projected to grow at a CAGR of approximately 25% over the next five years. This growth is driven by the need for actionable insights derived from vast amounts of healthcare data. As hospitals and clinics seek to enhance their service delivery, the integration of analytics into their operations becomes essential. The healthcare analytics market industry is thus positioned to play a pivotal role in transforming how healthcare services are delivered, ensuring that decisions are informed by robust data analysis.