Growth of E-commerce Platforms

The rapid expansion of e-commerce in India significantly influences the graphical user-interface-design-software market. As online shopping becomes more prevalent, businesses are investing in creating visually appealing and user-friendly websites. The e-commerce sector in India is expected to reach $200 billion by 2026, which underscores the necessity for effective design tools. Companies are increasingly recognizing that a well-designed interface can enhance customer engagement and drive sales. Consequently, the demand for graphical user-interface-design-software is likely to rise as businesses seek to differentiate themselves in a competitive market.

Adoption of Cloud-Based Solutions

The shift towards cloud-based solutions is transforming the landscape of the graphical user-interface-design-software market. Indian businesses are increasingly adopting cloud technologies to enhance collaboration and accessibility. This trend is particularly relevant for design teams that require real-time collaboration on projects. The cloud-based software market in India is projected to grow at a CAGR of 30% over the next few years. As organizations embrace remote work and distributed teams, the demand for graphical user-interface-design-software that supports cloud integration is expected to increase, driving market growth.

Focus on Enhanced User Experience

The emphasis on user experience (UX) is a critical driver for the graphical user-interface-design-software market. Companies in India are recognizing that a superior UX can lead to higher customer satisfaction and retention rates. As a result, there is a growing investment in design tools that enable the creation of seamless and engaging interfaces. Research indicates that businesses that prioritize UX can see conversion rates increase by up to 400%. This focus on user-centric design is likely to propel the demand for advanced graphical user-interface-design-software, as organizations strive to meet evolving consumer expectations.

Rise of Startups and Innovation Hubs

The burgeoning startup ecosystem in India is a significant catalyst for the graphical user-interface-design-software market. With thousands of startups emerging across various sectors, there is a heightened need for innovative design solutions. Startups often prioritize rapid prototyping and agile development, which necessitates the use of advanced graphical user-interface-design-software. The Indian startup landscape is projected to reach a valuation of $500 billion by 2025, indicating a robust demand for design tools that can support creative and efficient development processes. This trend is likely to drive the growth of the graphical user-interface-design-software market as startups seek to establish a strong digital presence.

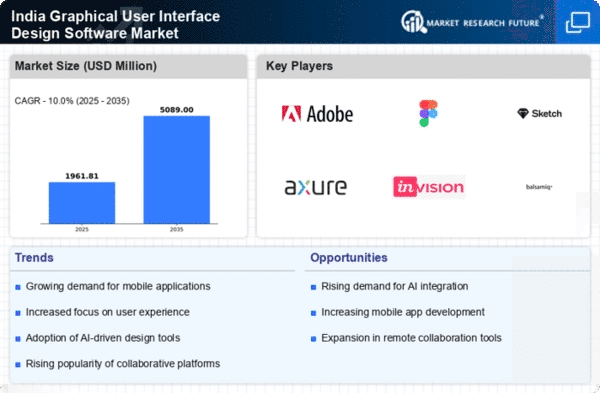

Increasing Demand for Mobile Applications

The surge in mobile application development in India is a primary driver for the graphical user-interface-design-software market. With the proliferation of smartphones, businesses are increasingly focusing on creating user-friendly mobile applications. According to recent data, the mobile app market in India is projected to reach $10 billion by 2025, indicating a robust growth trajectory. This demand necessitates advanced graphical user-interface-design-software that can facilitate the creation of intuitive and engaging interfaces. As companies strive to enhance user experience, the need for sophisticated design tools becomes paramount, thereby propelling the growth of the graphical user-interface-design-software market.