Emphasis on Aesthetic Design

In Japan, there is a strong cultural emphasis on aesthetics, which significantly influences the graphical user-interface-design-software market. Companies are increasingly recognizing that visually appealing interfaces can enhance user engagement and satisfaction. This trend is particularly evident in sectors such as e-commerce and entertainment, where the competition for user attention is fierce. Market analysis suggests that businesses investing in high-quality design software have seen an increase in user retention rates by up to 25%. As a result, the demand for sophisticated graphical user-interface-design-software that allows for creative and attractive designs is likely to continue growing, reflecting the unique preferences of Japanese consumers.

Expansion of E-Learning Platforms

The expansion of e-learning platforms in Japan is significantly impacting the graphical user-interface-design-software market. With educational institutions and businesses increasingly adopting online learning solutions, there is a growing need for user-friendly interfaces that enhance the learning experience. This trend is supported by market data indicating that the e-learning sector in Japan is expected to grow by 25% over the next few years. As a result, developers are seeking design software that enables the creation of engaging and interactive educational interfaces. The graphical user-interface-design-software market is thus poised to benefit from this surge in demand for e-learning solutions, as educational content becomes more accessible and appealing to users.

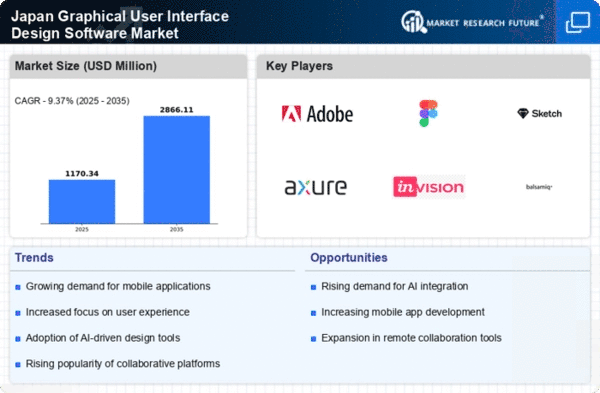

Rising Demand for Mobile Applications

The increasing prevalence of mobile devices in Japan has led to a heightened demand for mobile applications, which in turn drives the graphical user-interface-design-software market. As consumers increasingly rely on smartphones and tablets for various tasks, developers are compelled to create intuitive and visually appealing interfaces. This trend is reflected in the market data, which indicates that mobile app usage in Japan has surged by approximately 30% over the past year. Consequently, software that facilitates the design of user-friendly interfaces is becoming essential for developers aiming to capture the attention of mobile users. The graphical user-interface-design-software market is thus positioned to benefit from this growing need for mobile-centric design solutions.

Growing Importance of Accessibility Standards

In Japan, there is an increasing awareness of the need for accessibility in digital products, which is influencing the graphical user-interface-design-software market. As regulations and guidelines for accessibility become more stringent, developers are required to create interfaces that cater to users with disabilities. This shift is prompting a demand for design software that includes features specifically aimed at enhancing accessibility. Market data suggests that companies prioritizing accessibility in their design processes have experienced a 20% increase in customer satisfaction. Therefore, the graphical user-interface-design-software market is likely to see a rise in tools that facilitate compliance with accessibility standards, ensuring that all users can engage with digital content.

Technological Advancements in Software Development

The rapid pace of technological advancements in software development is a key driver for the graphical user-interface-design-software market in Japan. Innovations such as augmented reality (AR) and virtual reality (VR) are reshaping how interfaces are designed and experienced. As these technologies become more mainstream, there is a corresponding need for design software that can accommodate new functionalities and user interactions. The market is witnessing a shift towards tools that support these advanced features, with a projected growth rate of 15% in the next five years. This evolution indicates that the graphical user-interface-design-software market must adapt to incorporate these emerging technologies to remain competitive.