Technological Advancements

Technological advancements play a pivotal role in shaping the fingerprint biometrics market. Innovations in sensor technology, algorithms, and data processing capabilities are enhancing the accuracy and efficiency of fingerprint recognition systems. The introduction of capacitive and optical sensors has improved the reliability of biometric authentication, making it more appealing to businesses and consumers alike. Furthermore, the integration of artificial intelligence and machine learning in biometric systems is expected to enhance their performance, leading to a projected market growth of around 25% by 2030. As technology continues to evolve, the fingerprint biometrics market is likely to benefit from increased adoption across various industries, including retail, education, and transportation.

Increasing Security Concerns

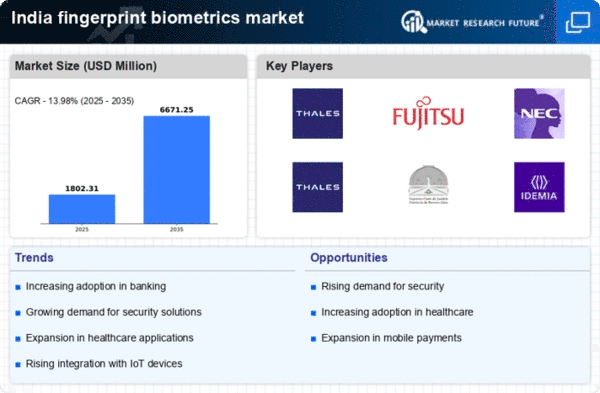

The fingerprint biometrics market is experiencing growth due to escalating security concerns across various sectors in India. With rising incidents of identity theft and fraud, organizations are increasingly adopting biometric solutions to enhance security measures. The market is projected to grow at a CAGR of approximately 20% from 2025 to 2030, driven by the need for secure authentication methods. Businesses are investing in fingerprint biometrics to protect sensitive data and ensure secure access to facilities. This trend is particularly evident in sectors such as banking, healthcare, and government, where safeguarding personal information is paramount. As security threats evolve, the demand for advanced biometric systems is likely to increase, further propelling the fingerprint biometrics market in India.

Rising Demand in E-Governance

The fingerprint biometrics market is experiencing a surge in demand due to the increasing emphasis on e-governance initiatives in India. The government is implementing digital identity solutions to streamline public services and enhance transparency. Initiatives such as the Aadhaar program have significantly contributed to the adoption of biometric systems for identity verification. As of 2025, over 1.3 billion Aadhaar enrollments have been recorded, showcasing the potential for biometric applications in various government services. This trend is expected to drive the fingerprint biometrics market, as more government agencies seek to implement secure and efficient identification methods to improve service delivery and reduce fraud.

Expansion of Biometric Regulations

The fingerprint biometrics market is influenced by the expansion of biometric regulations and standards in India. The government is actively formulating policies to regulate the use of biometric data, ensuring privacy and security for users. This regulatory framework is expected to foster consumer confidence in biometric systems, leading to increased adoption across various sectors. As organizations comply with these regulations, the demand for reliable and secure fingerprint biometrics solutions is likely to rise. The market is projected to grow by approximately 15% annually as businesses seek to align with regulatory requirements while enhancing their security protocols.

Growth in Mobile Payment Solutions

The fingerprint biometrics market is benefiting from the rapid growth of mobile payment solutions in India. With the increasing penetration of smartphones and the rise of digital wallets, consumers are seeking secure and convenient payment methods. Biometric authentication, particularly fingerprint recognition, is becoming a preferred choice for securing mobile transactions. As of 2025, it is estimated that mobile payment transactions in India will exceed $100 billion, with a significant portion utilizing biometric verification. This trend indicates a strong potential for the fingerprint biometrics market, as businesses and financial institutions prioritize security in mobile payment systems to enhance user trust and satisfaction.