Integration of Advanced Analytics

The integration of advanced analytics into the exposure management market is transforming how organizations assess and manage risks. By leveraging data analytics, companies can gain deeper insights into their risk profiles and make informed decisions. This trend is particularly relevant in India, where businesses are increasingly adopting data-driven approaches to enhance their risk management strategies. The use of predictive analytics and machine learning algorithms allows organizations to identify potential vulnerabilities and mitigate risks more effectively. As a result, the exposure management market is expected to witness substantial growth, with estimates suggesting an increase in market size by over 15% in the coming years. This analytical shift not only improves risk assessment but also fosters a culture of proactive risk management within organizations.

Emergence of Cloud-Based Solutions

The emergence of cloud-based solutions is reshaping the exposure management market in India. Organizations are increasingly adopting cloud technologies to enhance their risk management capabilities, driven by the need for flexibility, scalability, and cost-effectiveness. Cloud-based platforms enable businesses to access real-time data and analytics, facilitating more agile decision-making processes. This shift is particularly relevant in the context of the exposure management market, where timely access to information is crucial for effective risk assessment. As companies transition to cloud-based solutions, the market is expected to grow significantly, with projections indicating a potential increase of 18% in market size over the next few years. This trend underscores the importance of technological innovation in driving the evolution of exposure management practices.

Increased Focus on Operational Resilience

In the current business landscape, the emphasis on operational resilience is becoming a critical driver for the exposure management market. Organizations in India are prioritizing the development of robust frameworks that ensure continuity in the face of disruptions. This focus is largely influenced by the need to maintain business operations during unforeseen events, thereby safeguarding revenue streams and customer trust. The exposure management market is likely to benefit from this trend, as companies invest in resilience-building strategies. Recent studies indicate that organizations with strong operational resilience frameworks can reduce potential losses by up to 30%. Consequently, the demand for exposure management solutions that enhance resilience is expected to rise, further propelling market growth.

Rising Demand for Risk Mitigation Solutions

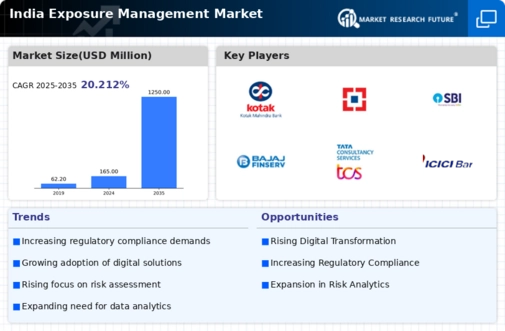

The exposure management market in India is experiencing a notable surge in demand for risk mitigation solutions. Organizations are increasingly recognizing the necessity of identifying and managing potential risks to safeguard their assets and reputation. This trend is driven by the growing complexity of business operations and the need for comprehensive risk assessment frameworks. According to recent data, the market is projected to grow at a CAGR of approximately 12% over the next five years. Companies are investing in advanced technologies and methodologies to enhance their risk management capabilities, thereby propelling the exposure management market forward. As businesses face evolving threats, the emphasis on proactive risk management strategies is likely to intensify, further solidifying the market's growth trajectory.

Growing Awareness of Compliance Requirements

The increasing awareness of compliance requirements is significantly impacting the exposure management market in India. Organizations are becoming more cognizant of the regulatory landscape and the implications of non-compliance. This awareness is driving the demand for exposure management solutions that facilitate adherence to various regulations and standards. As businesses strive to avoid penalties and reputational damage, the market is witnessing a shift towards solutions that offer comprehensive compliance management features. Recent data suggests that companies investing in compliance-related exposure management tools can reduce compliance-related costs by approximately 20%. This trend indicates a growing recognition of the importance of integrating compliance into risk management strategies, thereby enhancing the overall effectiveness of the exposure management market.