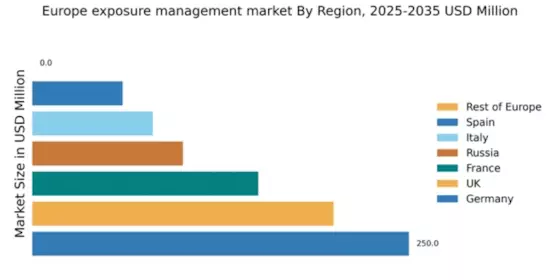

Germany : Strong Growth Driven by Innovation

Germany holds a dominant position in the European exposure management market, with a market value of $250.0 million, representing a significant share. Key growth drivers include robust industrial sectors, increasing regulatory compliance demands, and a focus on digital transformation. The government has initiated various policies to enhance cybersecurity and risk management frameworks, fostering a conducive environment for market expansion. Infrastructure development, particularly in technology and finance, further supports demand trends.

UK : Innovation and Regulation Drive Growth

The UK exposure management market is valued at $200.0 million, showcasing a strong demand for innovative solutions. Growth is driven by stringent regulatory requirements and a rising awareness of risk management among businesses. The UK government has implemented various initiatives to bolster cybersecurity, which is crucial for market expansion. The demand for tailored solutions is evident, with businesses increasingly seeking to integrate risk management into their operational frameworks.

France : Regulatory Focus Fuels Market Growth

France's exposure management market is valued at $150.0 million, reflecting a growing recognition of the importance of risk management. Key growth drivers include regulatory pressures and a shift towards digital solutions. The French government has introduced policies aimed at enhancing corporate governance and risk assessment practices, which are vital for market development. The increasing complexity of business operations necessitates advanced exposure management solutions.

Russia : Regulatory Landscape Shapes Demand

Russia's exposure management market is valued at $100.0 million, with growth driven by the need for improved risk management practices. The regulatory environment is evolving, with government initiatives aimed at enhancing corporate governance and compliance. However, geopolitical factors and economic fluctuations pose challenges. Key cities like Moscow and St. Petersburg are central to market activities, with local firms increasingly adopting exposure management solutions to navigate risks effectively.

Italy : Cultural Factors Influence Demand

Italy's exposure management market is valued at $80.0 million, characterized by a growing demand for risk management solutions. Economic shifts and regulatory changes are key growth drivers, with the government promoting initiatives to enhance corporate risk frameworks. The market is influenced by cultural factors, with businesses in regions like Lombardy and Lazio increasingly recognizing the importance of risk management in their operations. Local players are adapting to these trends by offering tailored solutions.

Spain : Regulatory Changes Drive Innovation

Spain's exposure management market is valued at $60.0 million, with growth driven by regulatory changes and an increasing focus on risk management. The Spanish government has implemented policies to enhance corporate governance, which is fostering demand for exposure management solutions. Key cities like Madrid and Barcelona are pivotal markets, with local firms seeking innovative solutions to address emerging risks. The competitive landscape includes both local and international players.

Rest of Europe : Diverse Needs Across Regions

The Rest of Europe represents an untapped market for exposure management solutions, with varying needs across different countries. While the market value is currently at $0.0 million, there is significant potential for growth as awareness of risk management increases. Regulatory frameworks are evolving, and governments are beginning to recognize the importance of exposure management. Local businesses are gradually adopting these solutions, driven by the need for compliance and risk mitigation.