Rising Geriatric Population

India's demographic shift towards an aging population is significantly impacting the ent treatment market. With the elderly being more susceptible to ENT disorders, including hearing impairment and chronic sinusitis, the demand for specialized treatments is on the rise. According to recent statistics, the geriatric population in India is expected to reach 300 million by 2050, which will likely increase the prevalence of ENT-related health issues. This demographic trend presents a substantial opportunity for the ent treatment market, as healthcare providers and pharmaceutical companies focus on developing targeted therapies and interventions tailored to the needs of older adults.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare access and affordability are driving growth in the ent treatment market. The Indian government has launched various schemes to enhance healthcare infrastructure, particularly in rural areas, where access to ENT specialists is limited. Increased funding for healthcare programs has led to the establishment of more ENT clinics and hospitals, thereby expanding the reach of treatment options. This proactive approach is expected to boost the ent treatment market, as more patients gain access to necessary treatments and interventions, ultimately improving health outcomes across the population.

Increasing Awareness of ENT Health

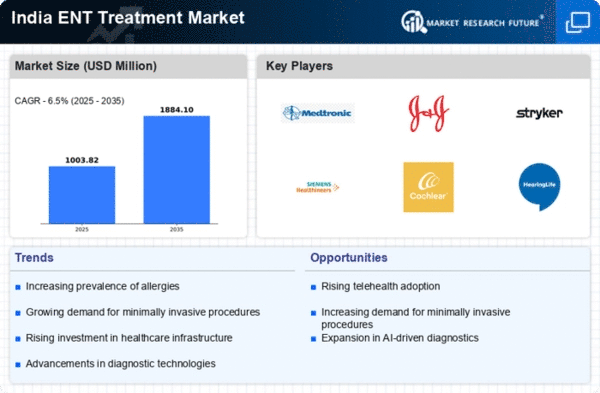

The growing awareness of ENT health issues among the Indian population is a crucial driver for the ent treatment market. Educational campaigns and health initiatives by government and non-governmental organizations have led to a heightened understanding of various ENT disorders. This awareness is reflected in the increasing number of patients seeking medical attention for conditions such as hearing loss, sinusitis, and allergies. As a result, the demand for ENT treatments is expected to rise, with the market projected to grow at a CAGR of approximately 8% over the next few years. The ent treatment market is likely to benefit from this trend as more individuals prioritize their health and seek timely interventions.

Advancements in Diagnostic Techniques

The ent treatment market is experiencing growth due to advancements in diagnostic techniques that enhance the accuracy and efficiency of ENT disorder detection. Innovations such as endoscopy, imaging technologies, and audiometric assessments are becoming more prevalent in clinical practice. These advancements allow for earlier diagnosis and more effective treatment plans, which are crucial for conditions like hearing loss and chronic ear infections. As healthcare providers adopt these technologies, the ent treatment market is likely to see an increase in patient referrals and treatment uptake, contributing to overall market expansion.

Rising Incidence of Allergies and Respiratory Disorders

The increasing incidence of allergies and respiratory disorders in India is a significant driver for the ent treatment market. Factors such as urbanization, pollution, and lifestyle changes have contributed to a rise in conditions like allergic rhinitis and asthma, which often require ENT interventions. Recent studies indicate that nearly 30% of the Indian population suffers from some form of allergy, leading to a growing demand for specialized treatments. This trend presents a substantial opportunity for the ent treatment market, as healthcare providers develop targeted therapies to address these prevalent health issues.