Increased Healthcare Expenditure

The rise in healthcare expenditure in South Korea is a significant driver for the ent treatment market. With the government and private sectors investing more in healthcare infrastructure, access to quality ENT services is improving. In 2025, healthcare spending is expected to account for approximately 8.5% of the GDP, indicating a robust commitment to enhancing health services. This increase in funding allows for the procurement of advanced medical equipment and the hiring of specialized personnel, thereby expanding the capacity of healthcare facilities to treat ENT disorders. Consequently, patients are more likely to seek treatment, further propelling the growth of the ent treatment market. The focus on preventive care and early diagnosis also plays a crucial role in this dynamic.

Rising Incidence of ENT Disorders

The increasing prevalence of ear, nose, and throat disorders in South Korea is a primary driver for the ent treatment market. According to health statistics, approximately 30% of the population experiences some form of ENT-related issue annually. This trend is likely to escalate due to urbanization and environmental factors, leading to higher exposure to pollutants. As a result, healthcare providers are compelled to enhance their service offerings, thereby expanding the ent treatment market. The demand for specialized treatments, including surgeries and therapies, is expected to grow, potentially increasing market revenues significantly. Furthermore, the aging population, which is more susceptible to ENT disorders, contributes to this rising incidence, indicating a sustained need for effective treatment solutions in the coming years.

Advancements in Medical Technology

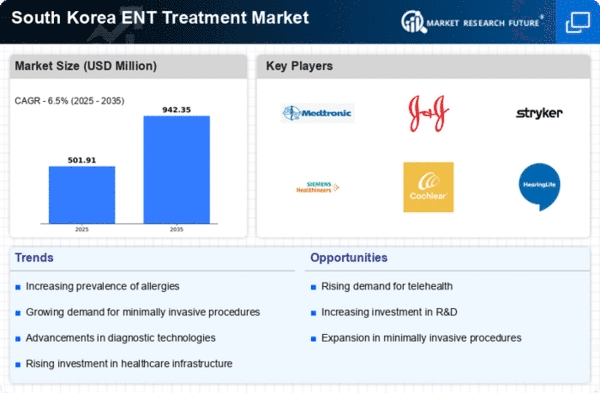

Innovations in medical technology are transforming the ent treatment market, particularly in South Korea. The introduction of minimally invasive surgical techniques and advanced diagnostic tools has improved patient outcomes and reduced recovery times. For instance, the use of robotic-assisted surgeries has gained traction, enhancing precision in procedures. The market for ENT devices is projected to reach approximately $1.5 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 7%. These advancements not only facilitate better treatment options but also attract more patients seeking effective solutions. As technology continues to evolve, the The market is likely to witness further growth, driven by the demand for state-of-the-art medical interventions.

Growing Demand for Personalized Medicine

The shift towards personalized medicine is influencing the ent treatment market in South Korea. Patients are increasingly seeking tailored treatment plans that cater to their specific needs and genetic profiles. This trend is supported by advancements in genomics and biotechnology, which enable healthcare providers to offer more effective and individualized therapies. As a result, the ent treatment market is likely to expand, with a focus on developing customized treatment protocols for various ENT disorders. The potential for improved patient satisfaction and outcomes may drive more individuals to seek specialized care, thereby enhancing market growth. Additionally, the integration of artificial intelligence in treatment planning could further refine personalized approaches, making them more accessible.

Rising Awareness of Preventive Healthcare

There is a growing awareness of preventive healthcare among the South Korean population, which is positively impacting the ent treatment market. Educational campaigns and health initiatives are encouraging individuals to seek regular check-ups and screenings for ENT disorders. This proactive approach is likely to lead to earlier diagnosis and treatment, reducing the severity of conditions and improving overall health outcomes. As awareness increases, more patients are expected to utilize ENT services, thereby driving market growth. The emphasis on preventive care aligns with national health policies aimed at reducing the burden of chronic diseases, suggesting a favorable environment for the ent treatment market to thrive in the coming years.