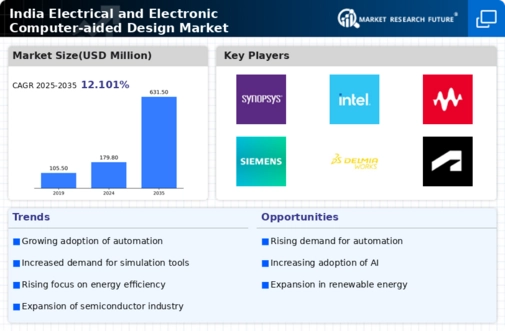

The electrical electronic computer aided design market in India is characterized by a dynamic competitive landscape, driven by rapid technological advancements and increasing demand for efficient design solutions. Key players such as Siemens (DE), Cadence Design Systems (US), and Synopsys (US) are at the forefront, each adopting distinct strategies to enhance their market presence. Siemens (DE) focuses on innovation and digital transformation, leveraging its extensive portfolio to integrate advanced technologies into its offerings. Cadence Design Systems (US) emphasizes partnerships and collaborations, particularly with local firms, to tailor solutions that meet regional needs. Synopsys (US), on the other hand, is heavily invested in AI integration, aiming to streamline design processes and improve efficiency across various sectors. Collectively, these strategies contribute to a competitive environment that is increasingly oriented towards technological sophistication and customer-centric solutions.

In terms of business tactics, companies are localizing manufacturing and optimizing supply chains to enhance operational efficiency. The market structure appears moderately fragmented, with several players vying for market share. However, the influence of major companies is substantial, as they set benchmarks for innovation and service quality. This competitive structure fosters an environment where smaller firms must continuously adapt to remain relevant, often leading to strategic partnerships or niche specialization.

In December 2025, Siemens (DE) announced the launch of its new cloud-based design platform, which aims to enhance collaboration among engineers and designers. This strategic move is significant as it aligns with the growing trend towards remote work and digital collaboration, positioning Siemens as a leader in providing flexible design solutions. The platform is expected to streamline workflows and reduce time-to-market for new products, thereby enhancing Siemens' competitive edge.

In November 2025, Cadence Design Systems (US) expanded its partnership with a prominent Indian semiconductor manufacturer, focusing on co-developing next-generation design tools. This collaboration is crucial as it not only strengthens Cadence's foothold in the Indian market but also allows for the customization of tools that cater specifically to local industry requirements. Such strategic alliances are likely to enhance Cadence's product offerings and improve customer satisfaction.

In October 2025, Synopsys (US) unveiled a new AI-driven tool aimed at automating various aspects of the design process. This innovation is particularly relevant as it addresses the industry's increasing demand for efficiency and speed. By integrating AI into its solutions, Synopsys positions itself as a forward-thinking player, likely attracting clients looking to enhance their design capabilities while reducing costs.

As of January 2026, current competitive trends in the market are heavily influenced by digitalization, sustainability, and AI integration. Strategic alliances are becoming increasingly vital, as companies recognize the need to collaborate to stay ahead in a rapidly evolving landscape. The shift from price-based competition to a focus on innovation, technology, and supply chain reliability is evident. Moving forward, competitive differentiation will likely hinge on the ability to deliver cutting-edge solutions that not only meet but anticipate customer needs.