Government Initiatives and Funding

Government initiatives play a crucial role in shaping the US Electrical Electronic Computer Aided Design Market. Various federal and state programs are designed to promote innovation in engineering and design technologies. For instance, the National Institute of Standards and Technology (NIST) has been actively involved in funding research and development projects that focus on improving CAD technologies. Additionally, the US government has allocated significant resources to support STEM education, which indirectly boosts the demand for CAD tools as more skilled professionals enter the workforce. This influx of talent is expected to drive the adoption of advanced CAD solutions across various sectors, further propelling market growth.

Emergence of 3D Printing Technologies

The emergence of 3D printing technologies is reshaping the landscape of the US Electrical Electronic Computer Aided Design Market. As 3D printing becomes more accessible and cost-effective, designers are increasingly leveraging CAD tools to create models that can be directly printed. This trend is particularly evident in industries such as healthcare, where custom prosthetics and implants are designed using CAD software. The ability to rapidly prototype and iterate designs has led to a surge in demand for CAD solutions that support 3D printing capabilities. Current estimates indicate that the 3D printing market in the US is expected to grow at a CAGR of 25% over the next five years, underscoring the transformative impact of this technology on the CAD industry.

Integration of IoT in Design Processes

The integration of the Internet of Things (IoT) into design processes is significantly influencing the US Electrical Electronic Computer Aided Design Market. As IoT devices proliferate, the demand for CAD tools that can accommodate the complexities of interconnected systems is on the rise. Designers are now tasked with creating products that not only function independently but also communicate with other devices. This shift necessitates the development of advanced CAD solutions that can model and simulate IoT environments effectively. Market analysts project that the IoT integration in CAD tools will contribute to a market expansion of approximately 7% over the next few years, highlighting the growing intersection of design and technology.

Increased Focus on Collaborative Design

Collaboration has become a cornerstone of the US Electrical Electronic Computer Aided Design Market. As organizations strive to enhance efficiency and innovation, the need for collaborative design tools has intensified. CAD software that facilitates real-time collaboration among teams is gaining traction, allowing for seamless communication and faster project completion. The rise of remote work and distributed teams has further amplified this trend, as companies seek solutions that enable effective collaboration regardless of geographical constraints. Market data suggests that the collaborative CAD segment is expected to witness a growth rate of around 6% annually, reflecting the increasing importance of teamwork in the design process.

Rising Demand for Advanced Manufacturing

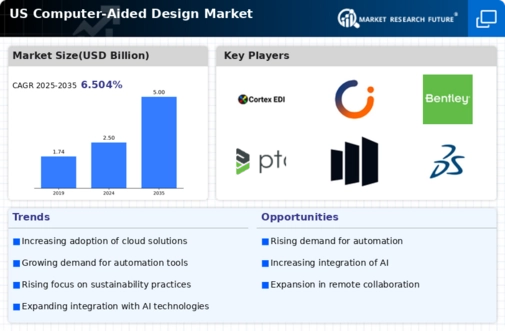

The US Electrical Electronic Computer Aided Design Market is experiencing a notable surge in demand for advanced manufacturing technologies. This trend is largely driven by the increasing complexity of electronic devices and the need for precision in design. As industries such as automotive, aerospace, and consumer electronics evolve, the requirement for sophisticated CAD tools becomes paramount. According to recent data, the market for advanced manufacturing in the US is projected to grow at a compound annual growth rate (CAGR) of approximately 5.5% over the next five years. This growth is indicative of a broader shift towards automation and digitalization, which necessitates the integration of advanced CAD solutions to streamline design processes and enhance productivity.