Public-Private Partnerships

Public-private partnerships (PPPs) are increasingly becoming a cornerstone of The India electric vehicle charging infrastructure market. Collaborations between government entities and private companies facilitate the rapid deployment of charging stations across urban and rural areas. For instance, several state governments have partnered with private firms to establish charging networks, leveraging private investment to expand infrastructure. As of January 2026, these partnerships are expected to accelerate the rollout of charging stations, with projections indicating a potential increase in the number of operational stations by over 50% in the next two years. This collaborative approach not only enhances accessibility but also fosters innovation within the india electric vehicle charging infrastructure market.

Supportive Regulatory Framework

A supportive regulatory framework is crucial for the development of The India electric vehicle charging infrastructure market. The Indian government has introduced various regulations aimed at simplifying the process of setting up charging stations, including streamlined licensing procedures and reduced tariffs for electricity used in charging. As of January 2026, these regulations are designed to encourage private sector participation and investment in charging infrastructure. Furthermore, the government is working on standardizing charging protocols to ensure compatibility across different EV models, which is expected to enhance consumer confidence in using electric vehicles. This regulatory support is likely to create a conducive environment for the growth of the india electric vehicle charging infrastructure market.

Government Initiatives and Policies

The Indian government has been actively promoting the adoption of electric vehicles (EVs) through various initiatives and policies, which significantly bolster The India electric vehicle charging infrastructure market. The Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, for instance, aims to incentivize the purchase of EVs and the establishment of charging stations. As of January 2026, the government has allocated substantial funds to enhance charging infrastructure, with a target of installing over 2,000 charging stations across major cities. This proactive approach not only encourages consumers to transition to EVs but also stimulates investments in the india electric vehicle charging infrastructure market, thereby creating a more robust ecosystem for electric mobility.

Growing Consumer Demand for Electric Vehicles

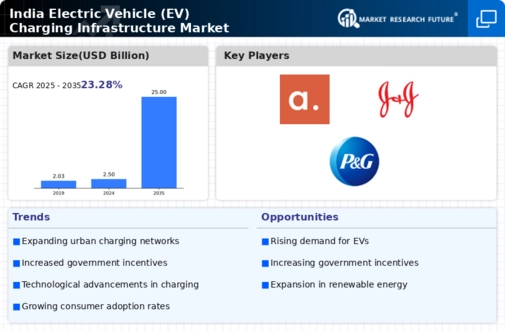

The increasing consumer demand for electric vehicles is a significant driver of The India electric vehicle charging infrastructure market. As awareness of environmental issues rises, more consumers are opting for EVs, leading to a surge in the need for accessible charging solutions. Market data indicates that EV sales in India have seen a year-on-year growth of over 30% as of January 2026. This growing demand necessitates the expansion of charging infrastructure to ensure that consumers have convenient access to charging stations. Consequently, the india electric vehicle charging infrastructure market is likely to experience substantial growth as stakeholders respond to this rising consumer interest by investing in new charging facilities.

Technological Advancements in Charging Solutions

Technological innovations play a pivotal role in shaping The India electric vehicle charging infrastructure market. The emergence of fast-charging technologies, such as DC fast chargers, has the potential to reduce charging times significantly, making EVs more appealing to consumers. As of January 2026, advancements in wireless charging and smart charging solutions are also gaining traction, allowing for more efficient energy management and integration with renewable energy sources. These innovations not only enhance user experience but also contribute to the overall growth of the india electric vehicle charging infrastructure market by addressing concerns related to charging speed and convenience, thus encouraging wider adoption of electric vehicles.