Increasing Prevalence of Diabetes

The rising incidence of diabetes in India is a primary driver for the digital diabetes-management market. According to the Indian Council of Medical Research, the prevalence of diabetes among adults has reached approximately 8.9% in urban areas and 4.5% in rural regions. This alarming trend necessitates innovative management solutions, leading to a surge in demand for digital tools that assist in monitoring and controlling blood sugar levels. The digital diabetes-management market is expected to expand as healthcare providers and patients seek effective ways to manage this chronic condition. Furthermore, the increasing awareness of diabetes complications is likely to propel the adoption of digital solutions, as individuals become more proactive in their health management. This growing concern about diabetes management is expected to significantly influence the market landscape in the coming years.

Government Initiatives and Support

Government initiatives aimed at improving healthcare access and diabetes management are significantly influencing the digital diabetes-management market. The Indian government has launched various programs to promote health awareness and provide resources for diabetes care. For instance, the National Health Mission emphasizes the importance of chronic disease management, which includes diabetes. Such initiatives are likely to encourage the adoption of digital health solutions, as they align with the government's objectives of enhancing healthcare delivery. Additionally, financial support and subsidies for digital health technologies may further stimulate market growth. The digital diabetes-management market is poised to benefit from these supportive policies, as they create an environment conducive to innovation and accessibility in diabetes care.

Technological Advancements in Healthcare

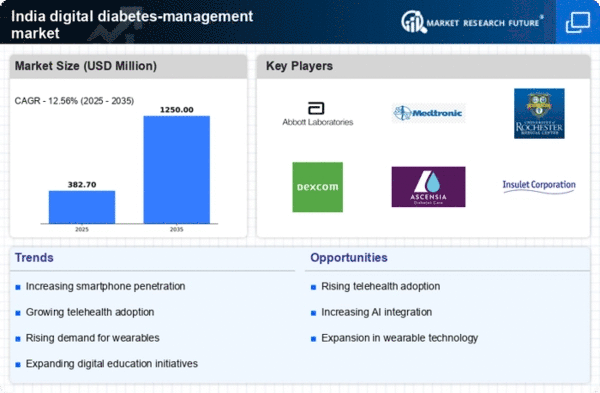

Technological advancements are playing a crucial role in shaping the digital diabetes-management market. Innovations in mobile applications, cloud computing, and data analytics are enabling more effective diabetes management solutions. For instance, the integration of artificial intelligence in diabetes management apps allows for personalized recommendations based on user data. This trend is likely to enhance user engagement and improve health outcomes. Moreover, the increasing penetration of smartphones and internet connectivity in India facilitates the adoption of these technologies. As a result, the digital diabetes-management market is expected to witness substantial growth, driven by the demand for more sophisticated and user-friendly management tools. The continuous evolution of technology in healthcare is anticipated to create new opportunities for market players.

Rising Health Consciousness Among Consumers

There is a notable increase in health consciousness among Indian consumers, which is driving the digital diabetes-management market. As individuals become more aware of the importance of maintaining a healthy lifestyle, they are increasingly seeking tools that assist in managing their health conditions. This trend is particularly evident among the younger population, who are more inclined to use digital solutions for health management. The digital diabetes-management market is likely to benefit from this shift in consumer behavior, as more people look for convenient and effective ways to monitor their health. Additionally, the growing trend of preventive healthcare is expected to further fuel the demand for digital diabetes management solutions, as individuals aim to prevent the onset of diabetes through proactive measures.

Collaboration Between Tech Companies and Healthcare Providers

The collaboration between technology companies and healthcare providers is emerging as a significant driver for the digital diabetes-management market. Partnerships between these entities are fostering the development of innovative solutions that cater to the needs of diabetes patients. For example, tech companies are leveraging their expertise in software development to create user-friendly applications, while healthcare providers offer insights into patient needs and clinical practices. This synergy is likely to enhance the effectiveness of digital diabetes management tools, making them more appealing to users. Furthermore, such collaborations may lead to the establishment of integrated care models that combine digital solutions with traditional healthcare services. The digital diabetes-management market is expected to thrive as these partnerships continue to evolve and expand.