Cost Efficiency and Accessibility

Cost efficiency is a crucial driver for the dental 3d-printing market, particularly in India, where affordability is a significant concern for both practitioners and patients. The ability to produce dental appliances in-house reduces outsourcing costs and minimizes turnaround times. Reports suggest that clinics utilizing 3D printing can reduce production costs by up to 40%, making dental care more accessible to a broader population. This economic advantage encourages more dental practices to invest in 3D printing technologies, thereby expanding the market. As the cost of 3D printers continues to decrease, it is anticipated that even smaller dental practices will adopt these technologies, further driving growth in the dental 3d-printing market.

Government Initiatives and Support

Government initiatives aimed at promoting advanced manufacturing technologies are positively impacting the dental 3d-printing market. In India, various programs and policies are being implemented to encourage innovation in the healthcare sector. These initiatives often include financial incentives, grants, and support for research and development. As a result, dental practices are more likely to invest in 3D printing technologies, knowing that they have governmental backing. This support not only fosters growth within the market but also enhances the overall quality of dental care available to patients. The collaboration between the government and the dental industry is expected to yield significant advancements in the dental 3d-printing market.

Increasing Awareness and Education

The rising awareness and education regarding the benefits of 3D printing in dentistry are driving the dental 3d-printing market in India. Dental professionals are increasingly recognizing the advantages of 3D printing, such as improved accuracy, reduced waste, and faster production times. Educational institutions are incorporating 3D printing technologies into their curricula, ensuring that new dentists are well-versed in these innovations. This growing knowledge base is likely to lead to a higher adoption rate of 3D printing technologies in dental practices. As more practitioners become proficient in utilizing these tools, the demand for 3D-printed dental solutions is expected to rise, further propelling the dental 3d-printing market.

Rising Demand for Aesthetic Dentistry

The growing emphasis on aesthetic dentistry is significantly influencing the dental 3d-printing market. In India, an increasing number of patients are seeking cosmetic dental procedures, which require precise and customized solutions. This trend is reflected in the market, where the demand for 3D-printed crowns, bridges, and aligners is on the rise. Reports indicate that the aesthetic dentistry segment is expected to grow by over 30% in the coming years. As dental practitioners aim to meet these evolving patient expectations, the ability to quickly produce tailored dental solutions through 3D printing becomes a competitive advantage. Consequently, this driver is likely to propel the market further, as more clinics adopt 3D printing technologies to enhance their service offerings.

Technological Advancements in 3D Printing

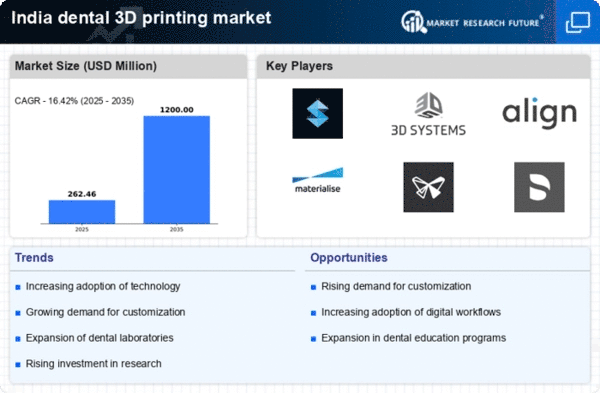

The dental 3d-printing market is experiencing rapid technological advancements that enhance the precision and efficiency of dental products. Innovations in materials and printing techniques, such as the use of biocompatible resins, are driving the market forward. In India, the adoption of advanced 3D printers has increased, with a reported growth rate of approximately 25% annually. This surge is attributed to the demand for high-quality dental prosthetics and orthodontic devices. As dental professionals seek to improve patient outcomes, the integration of these technologies into practice becomes essential. Furthermore, the ability to produce complex geometries and customized solutions positions the dental 3d-printing market as a pivotal player in the future of dental care.