Advancements in Material Science

Advancements in material science are significantly influencing the Dental 3D Printing Market. The development of new biocompatible materials suitable for dental applications has expanded the possibilities for 3D printing in dentistry. Innovations in resin formulations and metal alloys have led to stronger, more durable dental products that meet the rigorous demands of clinical use. As these materials become more accessible, dental practitioners are increasingly adopting 3D printing technologies to create crowns, bridges, and other restorations that not only meet aesthetic standards but also provide enhanced functionality. This trend suggests a robust future for the Dental 3D Printing Market as material options continue to evolve.

Cost Efficiency and Waste Reduction

Cost efficiency is a critical factor driving the Dental 3D Printing Market. Traditional manufacturing methods often involve significant material waste and longer production times. In contrast, 3D printing allows for precise material usage, reducing waste and lowering costs. This efficiency is particularly appealing to dental practices looking to optimize their operations. According to recent data, practices that have adopted 3D printing technologies report a reduction in production costs by up to 30%. This financial incentive, combined with the ability to produce high-quality dental products on-demand, is likely to encourage more dental professionals to invest in 3D printing solutions, further stimulating the Dental 3D Printing Market.

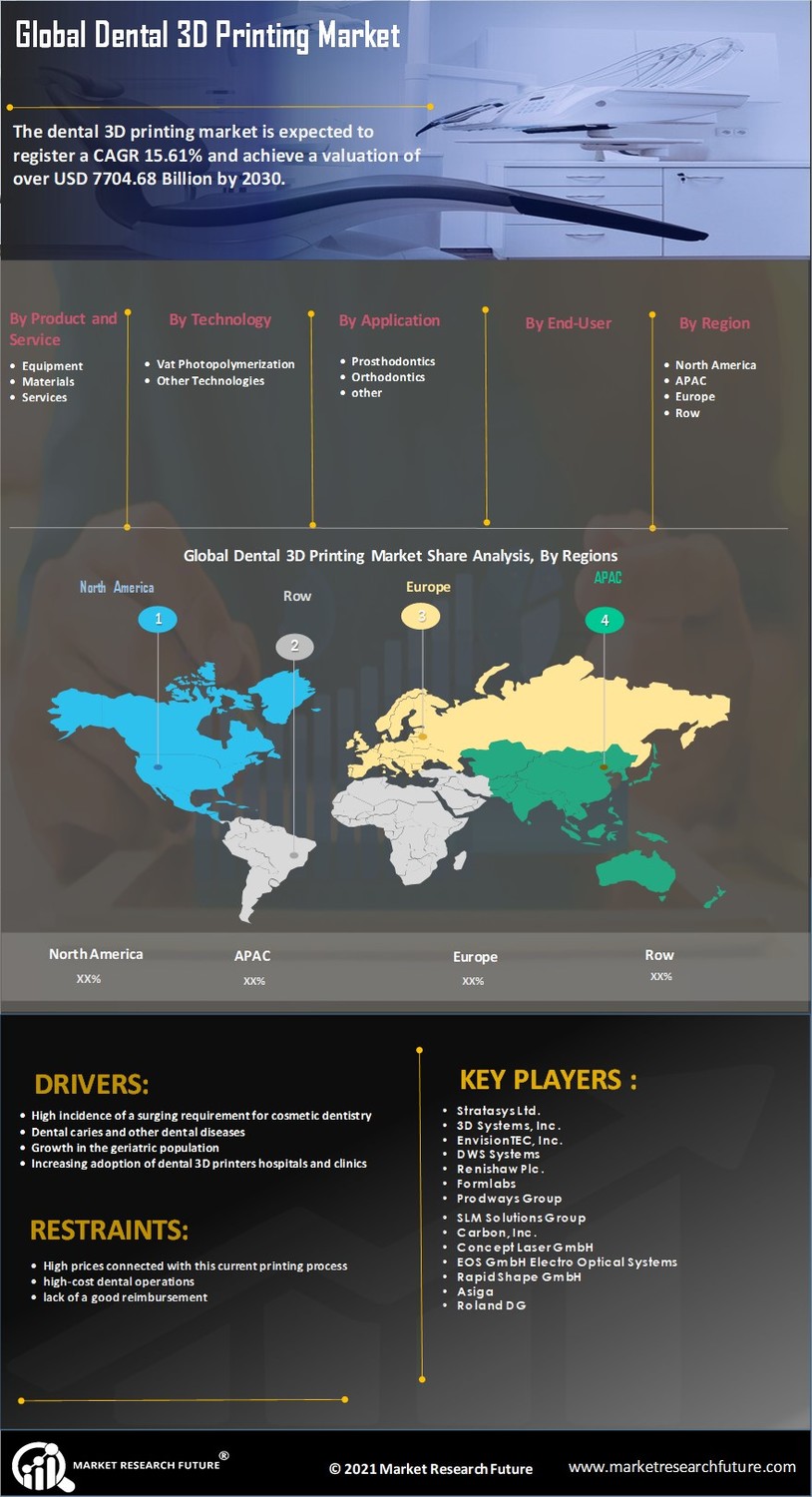

Rising Demand for Aesthetic Dentistry

The increasing emphasis on aesthetic dentistry is a notable driver for the Dental 3D Printing Market. Patients are increasingly seeking customized solutions for dental restorations, orthodontics, and prosthetics that enhance their appearance. This trend is reflected in the growing market for cosmetic dental procedures, which is projected to reach substantial figures in the coming years. As a result, dental professionals are turning to 3D printing technologies to create personalized dental solutions that meet patient expectations. The ability to produce intricate designs and tailored products quickly and efficiently positions 3D printing as a preferred method in aesthetic dentistry, thereby propelling the growth of the Dental 3D Printing Market.

Regulatory Support and Standardization

Regulatory support and standardization are emerging as vital drivers for the Dental 3D Printing Market. As the technology matures, regulatory bodies are beginning to establish guidelines and standards for the use of 3D printing in dental applications. This regulatory clarity is essential for ensuring product safety and efficacy, which in turn fosters greater confidence among dental practitioners and patients alike. The establishment of clear protocols may encourage more dental professionals to adopt 3D printing technologies, knowing that they comply with industry standards. Consequently, this regulatory environment is likely to enhance the growth trajectory of the Dental 3D Printing Market.

Increased Adoption of Digital Dentistry

The shift towards digital dentistry is a prominent driver for the Dental 3D Printing Market. As dental practices increasingly integrate digital tools such as intraoral scanners and CAD/CAM systems, the demand for 3D printing technologies rises correspondingly. Digital workflows streamline the design and production processes, allowing for faster turnaround times and improved accuracy in dental restorations. Recent statistics indicate that practices utilizing digital dentistry report higher patient satisfaction rates due to the precision and customization offered by 3D printed products. This growing trend towards digital solutions is likely to sustain the momentum of the Dental 3D Printing Market in the foreseeable future.