Rising Data Breaches

The increasing frequency of data breaches in India has heightened the demand for robust data protection measures. Organizations are now prioritizing data security to safeguard sensitive information from unauthorized access. the data masking market is expanding as businesses seek solutions to comply with regulations and protect customer data. In 2025, it is estimated that the cost of data breaches in India could reach $2.5 billion, prompting companies to invest in data masking technologies. This trend indicates a strong correlation between the rise in data breaches and the expansion of the data masking market, as firms recognize the necessity of implementing effective data protection strategies.

Expansion of Cloud Services

The rapid expansion of cloud services in India is influencing the data masking market significantly. As more businesses migrate to cloud platforms, the need for data protection becomes paramount. Data masking solutions are essential for securing sensitive information stored in the cloud, ensuring compliance with regulations while enabling organizations to leverage cloud technologies. The cloud services market in India is projected to grow to $10 billion by 2025, which will likely increase the demand for data masking solutions. This expansion indicates that the data masking market is poised for growth as organizations seek to protect their data in cloud environments.

Increased Regulatory Scrutiny

The heightened regulatory scrutiny in India regarding data protection is driving the growth of the data masking market. With the implementation of new data protection laws, organizations are compelled to adopt measures that ensure compliance and protect consumer data. The data masking market is expected to benefit from this trend, as companies seek to implement solutions that align with regulatory requirements. In 2025, it is anticipated that compliance-related expenditures will account for 15% of IT budgets in India, further emphasizing the importance of data masking technologies. This increased regulatory focus is a significant driver for the data masking market.

Adoption of Advanced Analytics

The increasing adoption of advanced analytics in various sectors, including finance and healthcare, is propelling the data masking market in India. Organizations are leveraging data analytics to gain insights while ensuring compliance with data protection regulations. The need to mask sensitive data during analysis is becoming crucial, as it allows businesses to utilize data without exposing personally identifiable information. In 2025, the analytics market in India is expected to reach $16 billion, which will likely drive the demand for data masking solutions. This trend suggests that the integration of data masking with analytics is essential for organizations aiming to harness the power of data responsibly.

Growing Awareness of Data Privacy

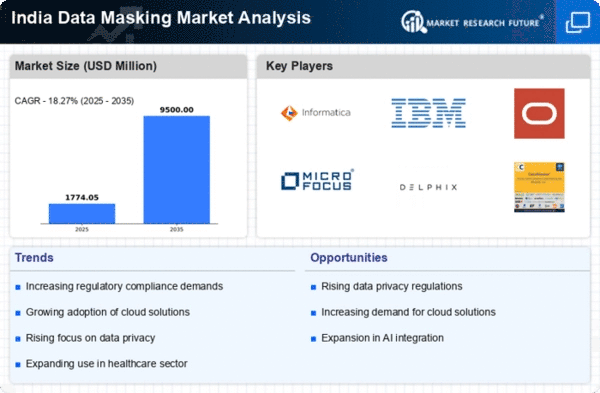

As awareness of data privacy issues increases among consumers and businesses in India, the data masking market is likely to see significant growth. Organizations are becoming more cognizant of the importance of protecting personal information, especially with the introduction of stringent data protection laws. The data masking market is projected to grow at a CAGR of 20% from 2025 to 2030, driven by the need for compliance and consumer trust. Companies are investing in data masking solutions to ensure that sensitive data is anonymized and protected, thereby enhancing their reputation and customer loyalty. This growing awareness is a key driver for the data masking market.