Emergence of 5G Technology

The rollout of 5G technology in India is poised to have a transformative impact on the data center-switch market. With its promise of ultra-fast connectivity and low latency, 5G is expected to drive a surge in data consumption and connectivity requirements. This technological advancement will necessitate the deployment of advanced switching solutions capable of handling increased data loads and ensuring efficient network performance. As industries such as IoT, smart cities, and autonomous vehicles gain traction, the demand for data centers equipped with high-performance switches will likely escalate. The data center-switch market is thus expected to experience significant growth as organizations prepare for the 5G revolution.

Increased Focus on Data Security

As cyber threats continue to evolve, there is a heightened focus on data security within the data center-switch market. Organizations in India are increasingly prioritizing the protection of sensitive information, leading to investments in secure switching technologies. The rise in data breaches and cyberattacks has prompted businesses to seek solutions that not only enhance performance but also ensure robust security measures. This trend is reflected in the growing demand for switches with integrated security features, such as encryption and access control. The data center-switch market is likely to benefit from this shift, as companies strive to safeguard their data while maintaining operational efficiency.

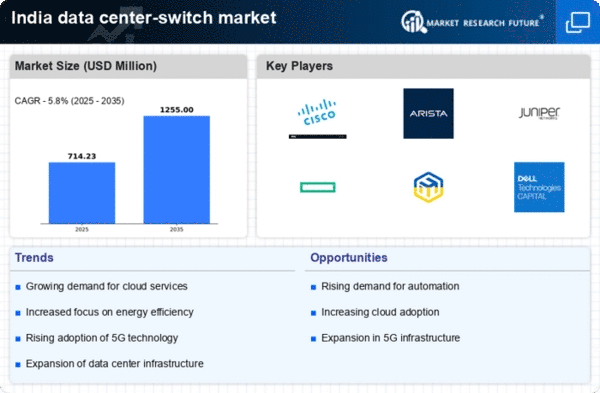

Rising Demand for Cloud Services

The increasing adoption of cloud computing in India is driving the data center-switch market. As businesses migrate to cloud-based solutions, the need for robust and efficient data center infrastructure becomes paramount. According to recent estimates, the cloud services market in India is projected to reach $10 billion by 2025, indicating a substantial growth trajectory. This surge in cloud adoption necessitates advanced switching technologies to ensure seamless connectivity and data transfer. Consequently, data center operators are investing in high-performance switches to meet the demands of cloud service providers. The data center-switch market is positioned to benefit from this trend. Organizations seek to enhance their network capabilities to support cloud applications and services.

Government Initiatives and Policies

The Indian government has been actively promoting digital transformation through various initiatives, which is positively impacting the data center-switch market. Programs such as Digital India aim to enhance the country's digital infrastructure, thereby increasing the demand for data centers. The government's push for data localization and the establishment of data protection regulations further necessitate the development of local data centers equipped with advanced switching technologies. As a result, investments in data center infrastructure are expected to rise, with projections indicating a growth rate of 15% annually in the data center sector. This supportive regulatory environment is likely to drive the demand for efficient and scalable data center-switch solutions.

Growth of E-commerce and Online Services

The rapid expansion of e-commerce and online services in India is significantly influencing the data center-switch market. With the rise of digital platforms, businesses are increasingly reliant on data centers to manage their operations and customer interactions. The e-commerce sector alone is expected to reach $200 billion by 2026, creating a substantial demand for data center infrastructure. This growth necessitates the deployment of high-capacity switches to handle increased data traffic and ensure reliable service delivery. As a result, data center operators are compelled to upgrade their switching technologies to accommodate the evolving needs of e-commerce and online service providers, thereby driving growth in the data center-switch market.