Growth of IoT Devices

The proliferation of Internet of Things (IoT) devices in Germany is significantly impacting the data center-switch market. With millions of devices connected to the internet, the need for efficient data management and processing becomes paramount. By 2025, it is projected that the number of IoT devices in Germany will exceed 1 billion, leading to an exponential increase in data traffic. This surge necessitates advanced switching solutions capable of handling diverse data streams and ensuring low latency. As organizations leverage IoT for various applications, including smart cities and industrial automation, the demand for scalable and reliable data center infrastructure grows. Consequently, the data center-switch market must adapt to these evolving requirements, driving innovation and investment in high-capacity switches that can accommodate the increasing data load.

Rising Cloud Adoption

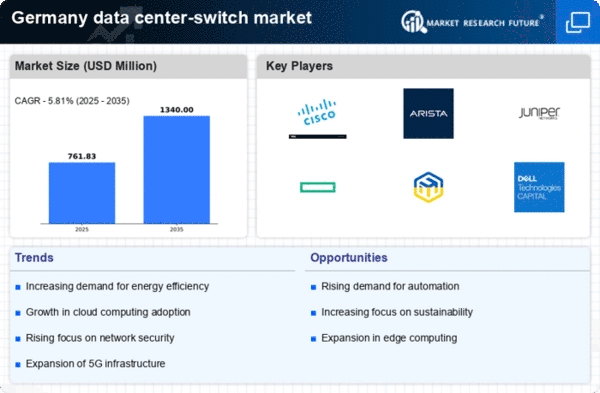

The increasing adoption of cloud computing services in Germany is driving the data center-switch market. As businesses migrate their operations to the cloud, the demand for robust and efficient data center infrastructure intensifies. In 2025, it is estimated that cloud services will account for approximately 30% of IT spending in the country. This shift necessitates advanced switching solutions that can handle large volumes of data traffic and ensure seamless connectivity. Consequently, data center-switch market players are focusing on developing high-performance switches that can support cloud-based applications and services. The trend towards hybrid cloud environments further amplifies this demand, as organizations seek to optimize their IT resources while maintaining flexibility. Thus, the rising cloud adoption is a pivotal driver for the data center-switch market in Germany.

Emergence of 5G Technology

The rollout of 5G technology in Germany is poised to transform the data center-switch market. With its promise of ultra-fast connectivity and low latency, 5G is expected to drive significant changes in data traffic patterns. By 2025, it is anticipated that 5G networks will support a vast array of applications, from autonomous vehicles to augmented reality, leading to an increase in data center traffic. This shift necessitates the deployment of advanced switching solutions capable of managing the heightened demand for bandwidth and ensuring reliable connectivity. As telecommunications companies invest in 5G infrastructure, the data center-switch market must adapt to support these new requirements, potentially leading to innovations in switch design and functionality. The emergence of 5G technology is thus a critical driver for the data center-switch market in Germany.

Increased Focus on Network Automation

The growing emphasis on network automation in Germany is influencing the data center-switch market. As organizations strive for greater efficiency and agility in their IT operations, the demand for automated switching solutions is on the rise. By 2025, it is projected that over 50% of enterprises in Germany will implement some form of network automation, driven by the need to reduce operational costs and enhance service delivery. This trend encourages data center-switch market players to develop solutions that integrate automation capabilities, enabling organizations to manage their networks more effectively. The shift towards automation not only streamlines operations but also enhances the ability to respond to changing business needs. Consequently, the increased focus on network automation is a significant driver for the data center-switch market.

Regulatory Compliance and Data Sovereignty

In Germany, stringent data protection regulations, such as the General Data Protection Regulation (GDPR), are influencing the data center-switch market. Organizations are compelled to ensure compliance with these regulations, which often necessitates localized data storage and processing. This requirement drives the demand for data center infrastructure that can support secure and compliant operations. As businesses seek to avoid hefty fines and maintain customer trust, investments in data center-switch solutions that prioritize security and data sovereignty are likely to increase. The data center-switch market must evolve to provide solutions that meet performance standards and adhere to regulatory requirements. This focus on compliance is expected to shape the market landscape, encouraging innovation in secure switching technologies.