Diverse Content Offerings

The cloud tv market in India is significantly influenced by the availability of diverse content offerings. Streaming platforms are increasingly curating a wide range of genres, including regional languages, international films, and original series, catering to the varied tastes of Indian audiences. As of November 2025, the demand for localized content has surged, with over 50% of viewers expressing a preference for shows in their native languages. This trend encourages cloud tv providers to invest in original programming and partnerships with local content creators, thereby enriching their libraries. The cloud tv market is likely to benefit from this diversification, as it attracts a broader audience and enhances viewer engagement.

Growing Mobile Viewership

The rise of mobile viewership is a critical driver for the cloud tv market in India. With mobile devices accounting for over 60% of total internet traffic, consumers increasingly prefer to watch content on their smartphones and tablets. This trend is particularly pronounced among younger demographics, who favor on-the-go access to entertainment. As mobile data costs continue to decline, more users are likely to subscribe to cloud tv services, enhancing the market's growth potential. The cloud tv market is adapting to this shift by optimizing content for mobile platforms, ensuring that users enjoy a seamless viewing experience regardless of their device. This focus on mobile accessibility is expected to further propel the market forward.

Increasing Internet Penetration

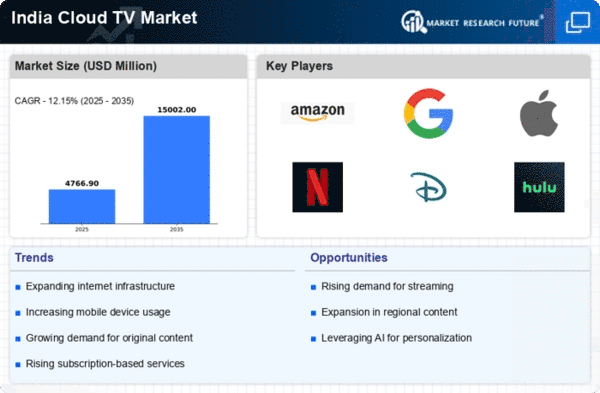

The cloud tv market in India is experiencing a notable boost due to the increasing penetration of the internet across urban and rural areas. As of November 2025, internet penetration in India stands at approximately 70%, with a significant portion of the population gaining access to high-speed broadband. This connectivity enables consumers to access cloud tv services seamlessly, thereby expanding the potential viewer base. The proliferation of affordable smartphones and smart TVs further facilitates this trend, allowing users to stream content effortlessly. Consequently, the cloud tv market is likely to witness substantial growth as more individuals embrace online streaming platforms, leading to a shift in viewing habits and preferences.

Cost-Effective Subscription Models

Cost-effective subscription models are reshaping the cloud tv market in India. With the increasing competition among streaming services, providers are offering flexible pricing plans that cater to different consumer segments. Many platforms now provide tiered subscription options, allowing users to choose plans based on their viewing preferences and budget. This approach not only makes cloud tv services more accessible but also encourages trial among potential subscribers. As a result, the cloud tv market is witnessing a surge in subscriptions, with many consumers opting for monthly or annual plans that fit their financial capabilities. This trend is expected to continue, driving further growth in the market.

Enhanced User Experience through Technology

Technological advancements play a pivotal role in enhancing user experience within the cloud tv market in India. Innovations such as artificial intelligence and machine learning are being integrated into streaming platforms to provide personalized content recommendations, improving viewer satisfaction. Additionally, features like offline viewing and multi-device support are becoming standard, allowing users to enjoy content without interruptions. As of November 2025, the emphasis on user experience is evident, with many platforms investing in user-friendly interfaces and interactive features. This focus on technology is likely to attract more subscribers to the cloud tv market, as consumers seek platforms that offer convenience and tailored viewing experiences.