Emergence of New Applications

The market is being driven by the emergence of new applications across various sectors.. Beyond pharmaceuticals, industries such as food and beverage, agrochemicals, and environmental testing are increasingly recognizing the importance of chiral separation techniques. For instance, the food industry requires chiral chromatography for the analysis of flavor compounds and additives, while agrochemical companies utilize it for the separation of chiral pesticides. This diversification of applications is likely to expand the market reach of chiral chromatography-columns, as more industries adopt these technologies to enhance product quality and compliance with regulatory standards. The potential for new applications could lead to a market expansion of approximately 10% over the next few years.

Growth in Biotechnology Sector

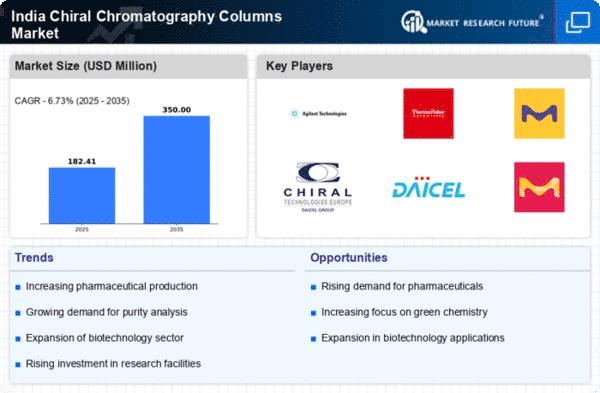

The biotechnology sector in India is witnessing rapid growth. This growth is significantly impacting the chiral chromatography-columns market.. With advancements in biopharmaceuticals and the increasing focus on biologics, there is a rising need for effective separation techniques to purify chiral compounds. The Indian biotechnology market is expected to reach $100 billion by 2025, driven by innovations in drug development and personalized medicine. Chiral chromatography plays a vital role in this context, as it enables the separation of enantiomers, which is crucial for the efficacy and safety of biopharmaceuticals. As biotechnology companies expand their research and production capabilities, the demand for chiral chromatography-columns is likely to increase, thereby driving market growth in this sector.

Rising Awareness of Quality Control

In India, there is a growing emphasis on quality control in various industries, particularly in pharmaceuticals and food processing. This trend is significantly influencing the chiral chromatography-columns market, as companies strive to meet regulatory standards and ensure product safety. The implementation of stringent quality assurance protocols necessitates the use of advanced analytical techniques, including chiral chromatography. As a result, the market for chiral chromatography-columns is expected to grow, with an increasing number of laboratories and manufacturing facilities adopting these technologies. The focus on quality control is further supported by government initiatives aimed at enhancing product safety and compliance, which could potentially lead to a market growth rate of around 15% annually in the coming years.

Increasing Demand for Pharmaceuticals

The chiral chromatography-columns market in India is experiencing a surge in demand, primarily driven by the expanding pharmaceutical sector.. As the country emerges as a hub for drug manufacturing, the need for efficient separation techniques becomes paramount. Chiral chromatography is essential for the production of enantiomerically pure compounds, which are crucial in drug formulation. The Indian pharmaceutical market is projected to reach $55 billion by 2025, indicating a robust growth trajectory. This growth is likely to propel the demand for chiral chromatography-columns, as pharmaceutical companies seek to enhance their production capabilities and ensure compliance with stringent quality standards. Consequently, the increasing demand for pharmaceuticals is a significant driver for the chiral chromatography-columns market, as it necessitates advanced analytical techniques for drug development and quality control.

Investment in Research and Development

Investment in research and development (R&D) is a critical driver for the chiral chromatography-columns market in India. As companies and research institutions allocate more resources towards R&D, the demand for advanced analytical techniques is expected to rise. This trend is particularly evident in the pharmaceutical and biotechnology sectors, where innovation is key to developing new drugs and therapies. The Indian government has been actively promoting R&D initiatives, which could lead to increased funding and collaboration between academia and industry. As a result, the chiral chromatography-columns market may benefit from enhanced technological advancements and increased adoption of these columns in various research applications. The anticipated growth in R&D investment could potentially boost the market by around 12% in the coming years.