Technological Innovations in Device Design

Technological advancements in the design and functionality of cardiovascular devices are significantly influencing the market. Innovations such as minimally invasive procedures, remote monitoring capabilities, and enhanced imaging techniques are transforming patient care. For instance, the introduction of bioresorbable stents and advanced cardiac monitoring devices has improved treatment efficacy and patient comfort. The cardiovascular devices market is projected to expand as manufacturers invest in research and development to create cutting-edge solutions that cater to the evolving needs of healthcare professionals and patients alike. This trend indicates a shift towards more personalized and effective cardiovascular care.

Government Support and Regulatory Framework

Government initiatives aimed at improving healthcare infrastructure and access to medical devices are crucial for the cardiovascular devices market. The Indian government has implemented various policies to promote the manufacturing and distribution of medical devices, including tax incentives and streamlined regulatory processes. These measures are designed to enhance local production and reduce dependency on imports. As a result, the cardiovascular devices market is likely to benefit from increased availability and affordability of essential devices, ultimately improving patient access to life-saving treatments. This supportive environment encourages innovation and investment in the sector.

Increasing Cardiovascular Disease Prevalence

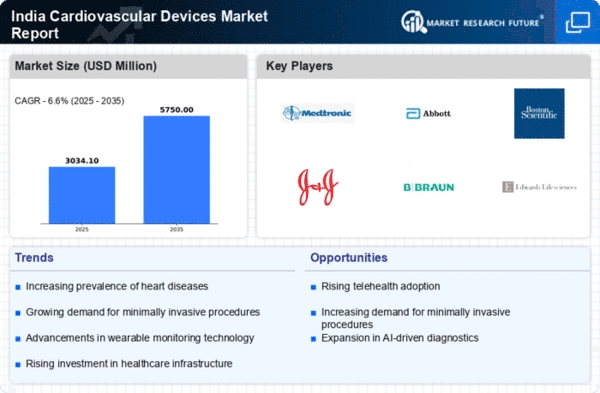

The rising incidence of cardiovascular diseases in India is a primary driver for the cardiovascular devices market. According to recent health statistics, cardiovascular diseases account for approximately 28% of all deaths in the country. This alarming trend necessitates the adoption of advanced cardiovascular devices for diagnosis and treatment. As the population ages and lifestyle-related health issues become more prevalent, the demand for devices such as stents, pacemakers, and defibrillators is expected to surge. The market is likely to experience substantial growth as healthcare providers seek to address this pressing health crisis, leading to increased investments in innovative technologies and improved patient outcomes.

Growing Investment in Healthcare Infrastructure

The expansion of healthcare infrastructure in India is a significant driver for the cardiovascular devices market. With increasing investments in hospitals, clinics, and diagnostic centers, the demand for advanced medical devices is on the rise. The government and private sector are collaborating to enhance healthcare facilities, which includes the procurement of state-of-the-art cardiovascular devices. This trend is expected to create a robust market environment, as healthcare providers seek to equip their facilities with the latest technology to improve patient care. Consequently, the cardiovascular devices market is poised for growth as infrastructure development continues.

Rising Middle-Class Population and Disposable Income

The growth of the middle-class population in India, coupled with rising disposable incomes, is positively impacting the cardiovascular devices market. As more individuals gain access to healthcare services, there is an increasing willingness to invest in preventive care and advanced medical treatments. This demographic shift is likely to drive demand for cardiovascular devices, as patients seek high-quality solutions for heart-related issues. The cardiovascular devices market may experience accelerated growth as healthcare providers cater to this emerging consumer base, offering a range of innovative products that align with their expectations for quality and efficacy.