Growing Awareness of Heart Health

The increasing awareness of heart health among the general population is driving the Cardiovascular Medical Device Market. Educational campaigns and initiatives aimed at promoting heart health have led to a more informed public, resulting in higher demand for preventive measures and medical interventions. As individuals become more conscious of risk factors associated with cardiovascular diseases, they are more likely to seek medical advice and treatment. This shift in consumer behavior is reflected in the rising sales of cardiovascular devices, as patients actively pursue options for monitoring and improving their heart health. Furthermore, healthcare providers are responding to this trend by offering more comprehensive cardiovascular care solutions, thereby expanding the market. The emphasis on preventive care is expected to continue, further bolstering the demand for innovative medical devices.

Increasing Healthcare Expenditure

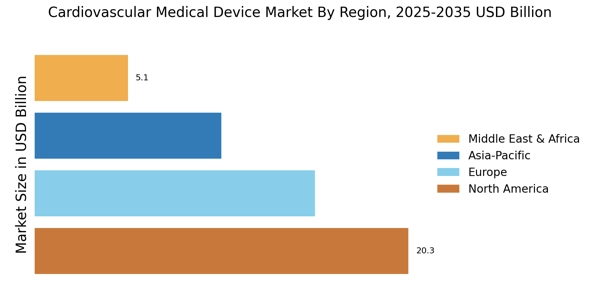

The rise in healthcare expenditure across various regions is a significant driver for the Cardiovascular Medical Device Market. Governments and private sectors are allocating more resources to healthcare, with spending on cardiovascular care witnessing notable increases. Reports indicate that healthcare spending is expected to reach trillions of dollars in the next few years, with a substantial portion directed towards cardiovascular health. This financial commitment facilitates the adoption of advanced medical technologies and devices, enhancing the quality of care provided to patients. Additionally, as healthcare systems prioritize the management of chronic diseases, the demand for cardiovascular devices is likely to escalate. This trend not only supports the growth of the market but also encourages innovation, as companies strive to meet the evolving needs of healthcare providers and patients alike.

Regulatory Support for Medical Innovations

Regulatory bodies are increasingly supporting the development and approval of new cardiovascular medical devices, which serves as a crucial driver for the Cardiovascular Medical Device Market. Streamlined approval processes and initiatives aimed at fostering innovation are encouraging manufacturers to bring new technologies to market more rapidly. For instance, the introduction of expedited pathways for breakthrough devices has significantly reduced the time required for approval, allowing for quicker access to life-saving technologies. This regulatory environment not only enhances competition among manufacturers but also stimulates investment in research and development. As a result, the market is likely to witness a surge in innovative products designed to address various cardiovascular conditions. The proactive stance of regulatory agencies is expected to contribute positively to the overall growth of the industry.

Rising Incidence of Cardiovascular Diseases

The increasing prevalence of cardiovascular diseases is a primary driver for the Cardiovascular Medical Device Market. According to recent statistics, cardiovascular diseases account for a substantial portion of global mortality rates, with estimates suggesting that they are responsible for nearly 31% of all deaths. This alarming trend necessitates the development and deployment of advanced medical devices aimed at prevention, diagnosis, and treatment. As healthcare systems strive to address this growing burden, investments in innovative cardiovascular technologies are likely to surge. The demand for devices such as stents, pacemakers, and implantable defibrillators is expected to rise, thereby propelling the market forward. Furthermore, the aging population, which is more susceptible to heart-related ailments, adds to the urgency for effective cardiovascular solutions, indicating a robust growth trajectory for the industry.

Technological Innovations in Medical Devices

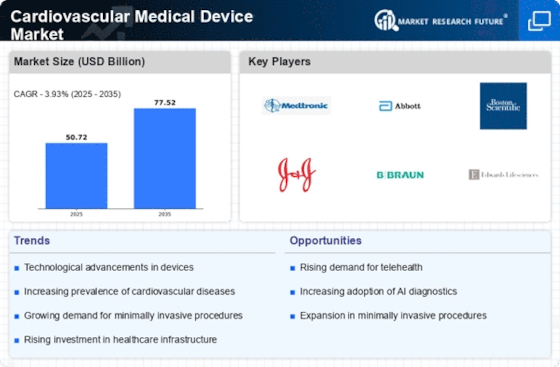

Technological advancements play a pivotal role in shaping the Cardiovascular Medical Device Market. Innovations such as 3D printing, artificial intelligence, and telemedicine are revolutionizing the way cardiovascular conditions are diagnosed and treated. For instance, the integration of AI in imaging technologies enhances the accuracy of diagnostics, leading to timely interventions. Moreover, the development of wearable devices that monitor heart health in real-time is gaining traction, appealing to both patients and healthcare providers. The market for these devices is projected to expand significantly, with estimates indicating a compound annual growth rate of over 10% in the coming years. As manufacturers continue to invest in research and development, the introduction of next-generation devices is anticipated, further driving market growth and improving patient outcomes.