Rising Geriatric Population

The demographic shift towards an aging population in India is a critical factor driving the India Cardiac Output Monitoring Device Market. As the geriatric population continues to grow, the prevalence of age-related cardiovascular conditions is expected to rise. According to the Ministry of Statistics and Programme Implementation, the proportion of individuals aged 60 and above is projected to reach 20% by 2050. This demographic trend necessitates the need for effective monitoring solutions to manage the health of older adults. Healthcare facilities are likely to expand their cardiac care services to cater to this population, leading to increased demand for cardiac output monitoring devices. As a result, the India Cardiac Output Monitoring Device Market is anticipated to experience substantial growth, driven by the healthcare needs of the aging population.

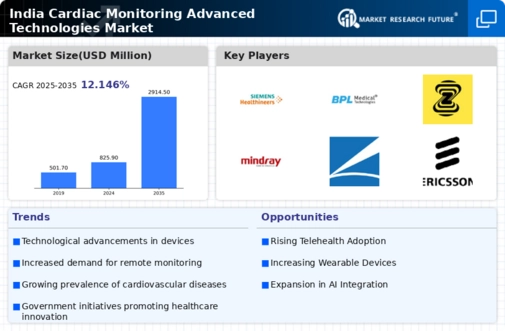

Government Initiatives and Support

Government initiatives aimed at improving healthcare infrastructure are significantly influencing the India Cardiac Output Monitoring Device Market. The Indian government has launched various programs to enhance healthcare access and quality, particularly in rural areas. Initiatives such as the Ayushman Bharat scheme aim to provide affordable healthcare services to millions of citizens. This increased focus on healthcare accessibility is likely to drive demand for cardiac monitoring devices, as hospitals and clinics expand their capabilities. Furthermore, the government's push for Make in India encourages domestic manufacturing of medical devices, potentially reducing costs and increasing availability. As a result, the India Cardiac Output Monitoring Device Market is expected to benefit from these supportive policies, fostering growth and innovation in the sector.

Growing Awareness of Preventive Healthcare

The rising awareness of preventive healthcare among the Indian population is a significant driver for the India Cardiac Output Monitoring Device Market. As individuals become more health-conscious, there is a growing emphasis on regular health check-ups and early detection of potential health issues. This shift in mindset is prompting healthcare providers to invest in advanced monitoring technologies, including cardiac output devices. Educational campaigns and health programs are further promoting the importance of monitoring cardiovascular health, leading to increased demand for these devices. The market is likely to see a surge in adoption as patients seek proactive measures to manage their heart health. Consequently, the India Cardiac Output Monitoring Device Market is positioned for growth, fueled by the increasing focus on preventive healthcare.

Rising Prevalence of Cardiovascular Diseases

The increasing incidence of cardiovascular diseases in India is a primary driver for the India Cardiac Output Monitoring Device Market. According to the National Health Profile, cardiovascular diseases account for approximately 28% of all deaths in India. This alarming statistic underscores the urgent need for effective monitoring solutions. As healthcare providers seek to improve patient outcomes, the demand for cardiac output monitoring devices is likely to rise. Hospitals and clinics are increasingly investing in advanced technologies to enhance their diagnostic capabilities. This trend is expected to continue, as the healthcare sector recognizes the importance of early detection and management of cardiovascular conditions. Consequently, the India Cardiac Output Monitoring Device Market is poised for growth, driven by the need to address the escalating burden of heart-related ailments.

Technological Innovations in Monitoring Devices

Technological advancements play a crucial role in shaping the India Cardiac Output Monitoring Device Market. Innovations such as non-invasive monitoring techniques and portable devices are gaining traction among healthcare professionals. These advancements not only enhance the accuracy of cardiac output measurements but also improve patient comfort and accessibility. For instance, the introduction of wearable devices that monitor cardiac output in real-time is revolutionizing patient care. The market is witnessing a surge in demand for devices that integrate with telemedicine platforms, allowing for remote monitoring and timely interventions. As healthcare providers increasingly adopt these technologies, the India Cardiac Output Monitoring Device Market is expected to experience significant growth, driven by the need for efficient and effective monitoring solutions.