Digital Transformation Initiatives

Digital transformation initiatives are significantly influencing The India Business Process as a Service market. As organizations strive to enhance their digital capabilities, they are increasingly adopting cloud-based solutions and automation technologies. This shift is not only improving operational efficiency but also enabling businesses to respond swiftly to market changes. The Indian government has been promoting digitalization through various initiatives, such as Digital India, which aims to transform the country into a digitally empowered society. This focus on digital transformation is expected to propel the growth of the business process as a service market, with many companies seeking to partner with service providers to facilitate their digital journeys.

Growing Demand for Cost Efficiency

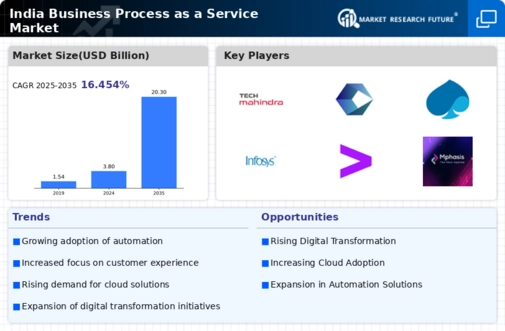

The India Business Process as a Service market is witnessing a growing demand for cost efficiency among enterprises. Organizations are increasingly seeking to reduce operational costs while maintaining service quality. By outsourcing business processes to specialized service providers, companies can leverage economies of scale and access advanced technologies without significant capital investment. According to recent estimates, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 15% over the next five years. This trend indicates that businesses are prioritizing cost-effective solutions, which is likely to drive the expansion of the business process as a service market in India.

Focus on Customer Experience Enhancement

Enhancing customer experience is a critical driver in The India Business Process as a Service market. Organizations are recognizing the importance of delivering exceptional customer service to retain clients and foster loyalty. Business process as a service providers are increasingly offering solutions that integrate customer relationship management (CRM) systems and analytics tools to improve service delivery. This focus on customer experience is supported by data indicating that companies prioritizing customer-centric strategies are likely to see revenue growth. As businesses strive to differentiate themselves in a competitive landscape, the demand for specialized service providers in the business process as a service market is expected to rise.

Regulatory Compliance and Risk Management

Regulatory compliance and risk management are becoming paramount in The India Business Process as a Service market. With the increasing complexity of regulations, businesses are compelled to ensure compliance with various laws and standards. Service providers specializing in business process outsourcing are well-equipped to help organizations navigate these challenges. The Reserve Bank of India and other regulatory bodies have established stringent guidelines that necessitate robust compliance frameworks. As a result, companies are likely to engage business process as a service providers to mitigate risks and ensure adherence to regulatory requirements, thereby driving market growth.

Rise of Remote Work and Flexible Solutions

The rise of remote work is reshaping The India Business Process as a Service market. As organizations adapt to new work environments, there is a growing need for flexible solutions that support remote operations. Business process as a service providers are stepping in to offer scalable and adaptable services that cater to the evolving needs of businesses. This trend is likely to continue, as companies seek to maintain productivity while accommodating a distributed workforce. The ability to access business processes remotely is becoming a key factor in selecting service providers, thereby driving the growth of the business process as a service market in India.