Growing Demand for Cost Efficiency

The Germany business process as a service market is experiencing a notable surge in demand for cost efficiency among enterprises. Organizations are increasingly seeking to optimize their operational expenditures by outsourcing non-core functions to specialized service providers. This trend is driven by the need to reduce overhead costs while maintaining service quality. According to recent data, companies that have adopted business process as a service solutions have reported a reduction in operational costs by up to 30%. This shift not only allows businesses to allocate resources more effectively but also enhances their competitive edge in the market. As a result, the demand for business process as a service offerings is expected to grow, reflecting a broader trend towards financial prudence in the German corporate landscape.

Focus on Customer Experience Enhancement

Enhancing customer experience is becoming a central focus for businesses in the Germany business process as a service market. Organizations are recognizing that superior customer service can lead to increased loyalty and revenue. As a result, many are turning to business process as a service solutions to streamline customer interactions and improve service delivery. By leveraging these services, companies can provide personalized experiences, reduce response times, and enhance overall satisfaction. Recent studies indicate that businesses utilizing these solutions have seen customer satisfaction scores rise by as much as 25%. This emphasis on customer experience is likely to propel the growth of the business process as a service market, as companies strive to differentiate themselves in a competitive landscape.

Regulatory Compliance and Data Protection

The Germany business process as a service market is significantly influenced by stringent regulatory compliance and data protection requirements. With the implementation of the General Data Protection Regulation (GDPR), businesses are compelled to ensure that their data handling practices align with legal standards. This has led to a heightened demand for business process as a service solutions that prioritize data security and compliance. Service providers are increasingly offering specialized solutions that address these regulatory challenges, thereby enabling organizations to mitigate risks associated with data breaches and non-compliance penalties. As a result, the market is witnessing a shift towards providers that can demonstrate robust compliance frameworks, which is likely to drive growth in the business process as a service sector in Germany.

Shift Towards Remote Work and Flexibility

The shift towards remote work is reshaping the Germany business process as a service market. As organizations adapt to new work environments, there is a growing need for flexible business solutions that can support remote operations. Business process as a service offerings provide the necessary infrastructure and tools to facilitate seamless collaboration among distributed teams. This trend is particularly relevant in Germany, where many companies are embracing hybrid work models. The flexibility offered by these services allows businesses to scale operations quickly and respond to changing market demands. Consequently, the business process as a service market is expected to witness substantial growth, as organizations seek to enhance their operational agility and resilience in an evolving work landscape.

Technological Advancements and Integration

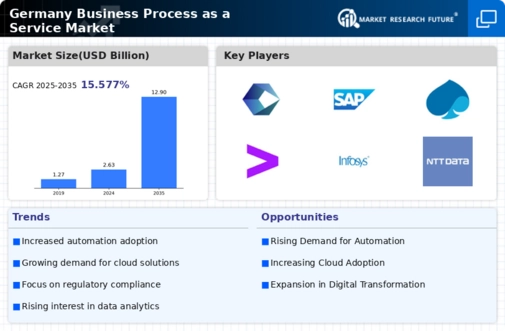

Technological advancements play a pivotal role in shaping the Germany business process as a service market. The integration of cutting-edge technologies such as artificial intelligence, machine learning, and cloud computing is transforming traditional business processes. These innovations enable service providers to offer more efficient, scalable, and flexible solutions tailored to the specific needs of German enterprises. For instance, the adoption of AI-driven analytics allows businesses to gain insights into their operations, leading to improved decision-making. As organizations increasingly recognize the value of these technologies, the market for business process as a service is likely to expand, with a projected growth rate of approximately 15% annually over the next five years. This trend underscores the importance of technological integration in enhancing operational efficiency.