Technological Advancements

Technological advancements play a pivotal role in shaping the Germany Building Automation System Market. Innovations in artificial intelligence, machine learning, and the Internet of Things (IoT) have revolutionized building management systems, enabling enhanced control and monitoring capabilities. For instance, smart sensors and automated controls allow for real-time data analysis, leading to improved energy management and operational efficiency. The integration of these technologies has led to a projected market growth rate of 10% annually, indicating a strong trend towards smart building solutions. As technology continues to evolve, the demand for sophisticated building automation systems is expected to rise, further propelling the market forward.

Growing Demand for Energy Efficiency

The growing demand for energy efficiency is a primary driver of the Germany Building Automation System Market. With rising energy costs and increasing environmental awareness, both consumers and businesses are seeking solutions that reduce energy consumption. Building automation systems provide the necessary tools to monitor and control energy usage effectively. In 2025, energy-efficient buildings accounted for over 60% of new constructions in Germany, highlighting a shift towards sustainable practices. This trend is likely to continue, as more stakeholders recognize the long-term cost savings associated with energy-efficient technologies. Consequently, the market for building automation systems is expected to expand, driven by this increasing demand for energy-efficient solutions.

Increased Focus on Health and Safety

The increased focus on health and safety within buildings is emerging as a crucial driver for the Germany Building Automation System Market. In light of growing concerns regarding indoor air quality and occupant well-being, building automation systems are being utilized to monitor and control environmental conditions. Features such as automated ventilation, lighting control, and temperature regulation contribute to healthier indoor environments. In 2025, approximately 40% of building automation projects in Germany prioritized health and safety features, indicating a shift in market demand. This focus is likely to continue, as stakeholders increasingly recognize the importance of creating safe and healthy spaces for occupants.

Government Regulations and Incentives

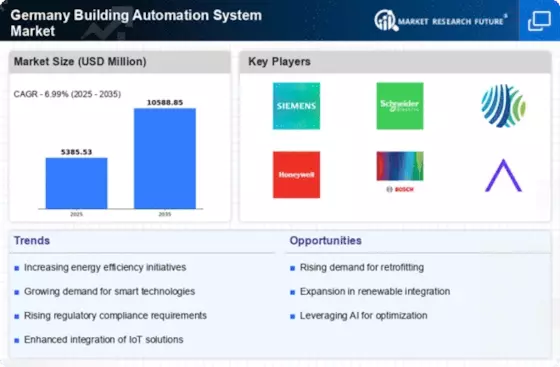

The Germany Building Automation System Market is significantly influenced by stringent government regulations aimed at enhancing energy efficiency and sustainability. The German government has implemented various policies, such as the Energy Saving Ordinance (EnEV), which mandates energy-efficient building practices. These regulations encourage the adoption of building automation systems that optimize energy consumption. Furthermore, financial incentives, such as grants and tax reductions for energy-efficient renovations, stimulate market growth. In 2025, the market was valued at approximately EUR 3 billion, reflecting a robust demand for automation solutions that comply with these regulations. As the government continues to prioritize sustainability, the market is likely to expand further, driven by compliance needs and financial incentives.

Urbanization and Infrastructure Development

Urbanization and infrastructure development are significant factors influencing the Germany Building Automation System Market. As urban areas continue to grow, there is an increasing need for efficient building management solutions that can accommodate the rising population. The German government has invested heavily in infrastructure projects, which include the integration of building automation systems in new developments. In 2025, urban areas accounted for approximately 75% of the total building automation market, underscoring the importance of urbanization in driving demand. This trend is expected to persist, as cities strive to enhance livability and sustainability through advanced building technologies.