Rise of Insurtech Startups

The blockchain insurance market in India is witnessing a proliferation of insurtech startups. These startups are leveraging blockchain technology to innovate and disrupt traditional insurance models. These startups are focusing on niche markets and offering tailored solutions that address specific consumer needs, such as microinsurance and peer-to-peer insurance. The insurtech sector has attracted substantial investment, with funding reaching approximately $1 billion in 2025. This influx of capital is likely to accelerate the development of blockchain-based insurance products. It will enhance competition and drive innovation within the market. As these startups gain traction, they may challenge established insurers. Insurers will need to adapt and evolve their offerings to remain relevant.

Increased Consumer Awareness

Consumer awareness regarding blockchain technology and its applications in the insurance sector is rising in India. Educational initiatives and digital campaigns are playing a crucial role in informing potential customers about the benefits of blockchain insurance products, such as enhanced security and streamlined processes. Surveys indicate that over 60% of consumers are now familiar with blockchain and its implications for insurance. This heightened awareness is likely to lead to increased demand for blockchain-based insurance solutions. Consumers seek products that align with their expectations for security and efficiency. Consequently, insurers may need to invest in marketing strategies. These strategies should effectively communicate the advantages of blockchain technology to capture this growing market segment.

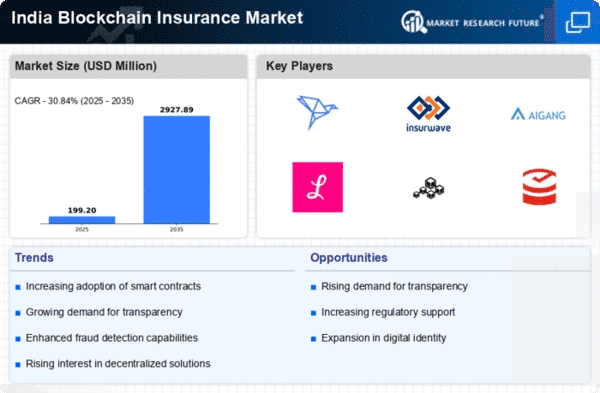

Growing Demand for Transparency

The blockchain insurance market in India is experiencing a notable surge in demand for transparency among consumers and businesses. This demand is driven by the inherent characteristics of blockchain technology, which offers immutable records and traceability. As consumers become more aware of their rights and the intricacies of insurance policies, they seek solutions that provide clear visibility into policy terms and claims processes. According to recent studies, approximately 70% of Indian consumers express a preference for insurance products that utilize blockchain for enhanced transparency. This trend is likely to propel the adoption of blockchain solutions within the insurance sector. Companies strive to meet consumer expectations and build trust in their offerings.

Supportive Regulatory Environment

The regulatory landscape in India is evolving to accommodate the blockchain insurance market. Authorities recognize the potential of blockchain technology to enhance operational efficiency and consumer protection. Recent initiatives by the Insurance Regulatory and Development Authority of India (IRDAI) indicate a willingness to explore regulatory frameworks that support blockchain adoption. This supportive environment is likely to encourage traditional insurers and new entrants to invest in blockchain solutions. This will foster innovation and competition. As regulations become more favorable, the blockchain insurance market may experience accelerated growth. Companies will be eager to comply with new standards while leveraging the advantages of blockchain technology.

Cost Efficiency through Automation

Cost efficiency is emerging as a pivotal driver in the blockchain insurance market in India. The integration of blockchain technology facilitates automation of various processes, such as claims processing and underwriting, which traditionally require significant manual intervention. By leveraging smart contracts, insurers can automate claims verification and payment, reducing operational costs by an estimated 30%. This efficiency not only benefits insurance companies but also enhances customer satisfaction by expediting claims resolution. As the market evolves, the potential for cost savings is likely to attract more players to adopt blockchain solutions, thereby fostering a competitive landscape that prioritizes efficiency and customer-centric services.