Government Initiatives and Support

The Indian government has been actively promoting the biopharmaceuticals market through various initiatives aimed at enhancing research and development capabilities. Programs such as the Biotechnology Industry Research Assistance Council (BIRAC) provide funding and support for startups and established companies in the biopharmaceutical sector. Additionally, the government has implemented policies to streamline regulatory processes, which may facilitate faster approvals for new biopharmaceutical products. This supportive environment is expected to attract both domestic and foreign investments, potentially leading to a more dynamic biopharmaceuticals market in India. The government's commitment to improving healthcare access further underscores the importance of this sector.

Growing Focus on Regulatory Compliance

The biopharmaceuticals market in India is witnessing an increasing emphasis on regulatory compliance, which is crucial for ensuring the safety and efficacy of biopharmaceutical products. Regulatory bodies are enhancing their frameworks to align with international standards, thereby fostering greater trust in biopharmaceuticals. This focus on compliance is likely to encourage more companies to enter the market, as adherence to stringent regulations can enhance product credibility. Furthermore, the establishment of clear guidelines may facilitate smoother market entry for innovative therapies, potentially expanding the biopharmaceuticals market in India. As companies prioritize compliance, the overall quality of products in the market is expected to improve.

Increasing Demand for Advanced Therapies

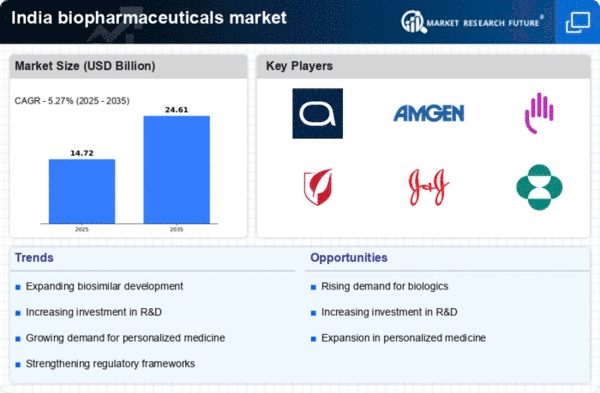

The biopharmaceuticals market in India is experiencing a notable surge in demand for advanced therapies, particularly in the treatment of chronic diseases. This trend is driven by a growing population with increasing healthcare needs and a rising prevalence of conditions such as diabetes and cancer. According to recent estimates, the biopharmaceuticals market is projected to reach approximately $30 billion by 2025, reflecting a compound annual growth rate (CAGR) of around 15%. The increasing awareness of innovative treatment options among healthcare professionals and patients alike is likely to further propel this demand, indicating a robust growth trajectory for the biopharmaceuticals market in India.

Technological Advancements in Manufacturing

Technological advancements in biopharmaceutical manufacturing processes are significantly impacting the biopharmaceuticals market in India. Innovations such as continuous manufacturing and process analytical technology (PAT) are enhancing production efficiency and product quality. These advancements not only reduce costs but also enable companies to respond more swiftly to market demands. As a result, the biopharmaceuticals market is likely to benefit from increased production capabilities and reduced time-to-market for new therapies. The integration of automation and artificial intelligence in manufacturing processes may further streamline operations, positioning India as a competitive player in The biopharmaceuticals market.

Rising Investment in Biopharmaceutical Research

Investment in biopharmaceutical research is on the rise in India, driven by both public and private sectors. This influx of capital is directed towards the development of novel therapies and the exploration of new drug delivery systems. Recent reports indicate that the biopharmaceuticals market is expected to see an investment increase of approximately 20% over the next five years. This trend suggests a growing recognition of the potential for biopharmaceuticals to address unmet medical needs. The collaboration between academic institutions and industry players is likely to foster innovation, further enhancing the biopharmaceuticals market landscape in India.