Support from Health and Fitness Industry

The bioimpedance analyzers market is receiving substantial support from the health and fitness industry in India. Gyms, fitness centers, and wellness clinics are increasingly incorporating bioimpedance analyzers into their services to provide clients with detailed assessments of their body composition. This trend is driven by the growing emphasis on personalized fitness programs and the need for accurate data to track progress. As fitness professionals recognize the value of bioimpedance analysis in tailoring workout regimens and nutritional plans, the demand for these devices is likely to rise. Additionally, partnerships between bioimpedance analyzer manufacturers and fitness organizations may further enhance market penetration. The health and fitness sector's endorsement of these devices is expected to contribute significantly to the market's growth, with projections indicating a potential market size of $40 million by 2026.

Growing Awareness of Preventive Healthcare

The bioimpedance analyzers market is benefiting from a growing awareness of preventive healthcare among the Indian population. As individuals become more informed about the importance of maintaining optimal health, there is a corresponding increase in the demand for tools that facilitate proactive health management. Bioimpedance analyzers provide valuable insights into body composition, hydration levels, and metabolic health, enabling users to make informed lifestyle choices. This shift towards preventive healthcare is reflected in the rising sales of bioimpedance devices, which have seen a growth rate of approximately 15% annually. Additionally, health campaigns and educational programs promoting the significance of regular health monitoring are likely to further bolster the market. Consequently, the bioimpedance analyzers market is poised for continued expansion as more consumers prioritize their health and well-being.

Rising Demand for Non-Invasive Health Monitoring

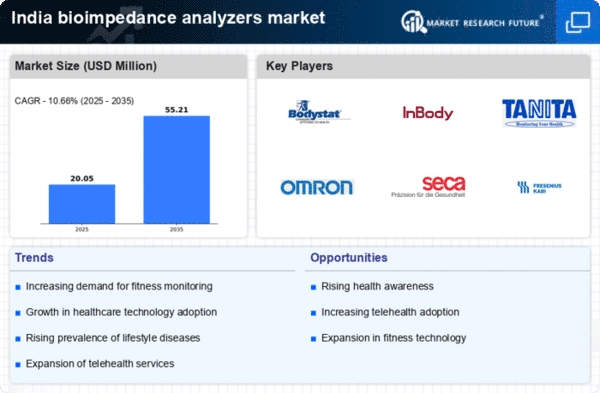

The The bioimpedance analyzers market in India is experiencing a notable surge in demand for non-invasive health monitoring solutions. As individuals increasingly seek convenient and accurate methods to assess their health metrics, bioimpedance technology offers a compelling alternative. This trend is particularly pronounced among fitness enthusiasts and individuals managing chronic conditions, who prefer devices that provide real-time data without the discomfort associated with invasive procedures. The market is projected to grow at a CAGR of approximately 10% over the next five years, driven by this rising demand. Furthermore, the increasing prevalence of lifestyle-related diseases in India necessitates regular health assessments, further propelling the adoption of bioimpedance analyzers. Consequently, the market is likely to expand as more consumers recognize the benefits of these devices for personal health management.

Technological Innovations Enhancing Device Functionality

Technological innovations are playing a crucial role in enhancing the functionality of bioimpedance analyzers, thereby driving the market in India. Recent advancements in sensor technology and data analytics have led to the development of more accurate and user-friendly devices. These innovations allow for improved measurement precision and the ability to track a wider range of health metrics, such as muscle mass, fat distribution, and hydration levels. As manufacturers invest in research and development to create cutting-edge products, the bioimpedance analyzers market is likely to experience increased competition and growth. Furthermore, the introduction of smart devices that integrate with mobile applications for real-time health tracking is expected to attract a broader consumer base. This trend suggests a promising future for the market, with potential revenue growth projected to reach $75 million by 2028.

Integration of Bioimpedance Technology in Healthcare Systems

The integration of bioimpedance technology into existing healthcare systems in India is a significant driver for the bioimpedance analyzers market. Hospitals and clinics are increasingly adopting these devices to enhance patient care and streamline health assessments. By incorporating bioimpedance analyzers into routine check-ups, healthcare providers can obtain comprehensive body composition data, which aids in diagnosing and monitoring various health conditions. This integration is supported by government initiatives aimed at modernizing healthcare infrastructure, which may lead to increased funding and resources for advanced diagnostic tools. As a result, the The bioimpedance analyzers market was expected to witness substantial growth, with an estimated increase in market value reaching $50 million by 2027. This trend indicates a shift towards more data-driven healthcare practices, emphasizing the importance of accurate body composition analysis.