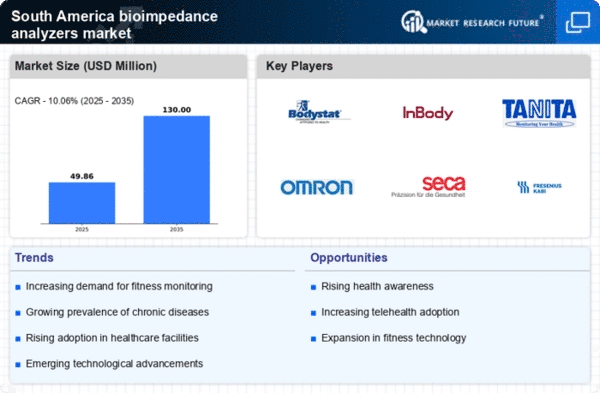

Rising Health Awareness

The increasing awareness of health and wellness among the population in South America is driving the bioimpedance analyzers market. As individuals become more conscious of their body composition and overall health, the demand for accurate and non-invasive measurement tools rises. This trend is particularly evident in urban areas where lifestyle diseases are prevalent. The bioimpedance analyzers market is likely to benefit from this shift, as consumers seek reliable methods to monitor their health metrics. Furthermore, educational campaigns by health organizations are promoting the importance of body composition analysis, which could potentially lead to a market growth rate of around 15% annually in the coming years.

Growing Fitness Industry

The expansion of the fitness industry in South America is significantly impacting the bioimpedance analyzers market. With a surge in fitness centers, personal training services, and wellness programs, there is an increasing need for tools that provide detailed insights into body composition. Fitness professionals are incorporating bioimpedance analyzers into their services to offer personalized training and nutrition plans. This trend is expected to contribute to a market valuation of approximately $50 million by 2026. The bioimpedance analyzers market is thus poised for growth as fitness enthusiasts and professionals alike recognize the value of precise body composition data.

Government Health Initiatives

Government initiatives aimed at improving public health in South America are fostering growth in the bioimpedance analyzers market. Programs focused on obesity prevention and chronic disease management are encouraging the use of body composition analysis tools. By providing funding and resources for health screenings, governments are indirectly promoting the adoption of bioimpedance analyzers in clinical settings. This support could lead to a market increase of around 10% as healthcare facilities invest in these technologies to comply with health regulations and improve patient care. The bioimpedance analyzers market stands to gain from such proactive measures.

Aging Population and Chronic Diseases

The aging population in South America is a significant factor influencing the bioimpedance analyzers market. As the demographic shifts towards an older age group, the prevalence of chronic diseases such as diabetes and cardiovascular conditions increases. This demographic is more likely to require regular monitoring of body composition to manage their health effectively. The bioimpedance analyzers market is expected to see a rise in demand as healthcare providers seek efficient ways to assess and manage these conditions. Projections indicate that the market could grow by 12% annually, driven by the need for tailored healthcare solutions for the elderly.

Technological Integration in Healthcare

The integration of advanced technologies in healthcare is a key driver for the bioimpedance analyzers market. Innovations such as mobile applications and cloud-based data management systems are enhancing the functionality of bioimpedance devices. These technologies allow for real-time monitoring and analysis, making it easier for healthcare providers to track patient progress. In South America, the adoption of such technologies is expected to increase by 20% over the next few years, thereby expanding the bioimpedance analyzers market. This integration not only improves patient outcomes but also streamlines the workflow for healthcare professionals.