Rising Awareness of Eye Health

Rising awareness of eye health among the Indian population is emerging as a significant driver for the Anti-VEGF Market. Educational campaigns and initiatives by healthcare organizations are helping to inform the public about the risks associated with ocular diseases and the importance of early detection and treatment. This heightened awareness is likely to lead to an increase in patient consultations and subsequent demand for anti-VEGF therapies. As individuals become more proactive about their eye health, the anti vegf market is expected to see a surge in the number of patients seeking treatment for conditions such as age-related macular degeneration and diabetic retinopathy. This trend indicates a positive outlook for the market as awareness continues to grow.

Increasing Prevalence of Diabetic Retinopathy

The Anti-VEGF Market in India is experiencing growth due to the rising prevalence of diabetic retinopathy, a common complication of diabetes. As the number of diabetes cases continues to escalate, the demand for effective treatments is likely to increase. Reports indicate that approximately 77 million people in India are currently living with diabetes, and this number is projected to rise. Consequently, the anti vegf market is poised to benefit from the growing need for therapies that can mitigate the effects of diabetic retinopathy, which can lead to vision loss if left untreated. The increasing awareness among healthcare professionals and patients about the importance of early intervention further fuels the demand for anti-VEGF therapies, making it a critical driver for the market's expansion.

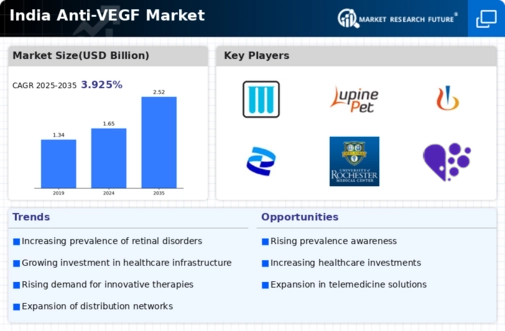

Growing Investment in Healthcare Infrastructure

The Anti-VEGF Market in India is benefiting from the growing investment in healthcare infrastructure. The Indian government has been actively working to enhance healthcare facilities, particularly in urban and rural areas. This investment is expected to improve access to advanced medical treatments, including anti-VEGF therapies. With the establishment of new hospitals and clinics, the availability of specialized eye care services is likely to increase. Furthermore, the government's initiatives to promote public health awareness regarding ocular diseases are expected to drive demand for anti-VEGF treatments. As healthcare infrastructure continues to develop, the anti vegf market is positioned for growth, catering to a larger patient population in need of effective therapies.

Technological Innovations in Drug Delivery Systems

Technological advancements in drug delivery systems are significantly impacting the Anti-VEGF Market in India. Innovations such as sustained-release formulations and targeted delivery mechanisms enhance the efficacy of anti-VEGF therapies. These advancements not only improve patient compliance but also optimize therapeutic outcomes. For instance, the introduction of intravitreal implants has shown promise in providing prolonged drug release, thereby reducing the frequency of injections required. This is particularly relevant in a country like India, where access to healthcare facilities can be limited. As a result, the anti vegf market is likely to witness increased adoption of these innovative delivery systems, which could lead to improved patient outcomes and a more robust market presence.

Supportive Regulatory Environment for New Treatments

The Anti-VEGF Market in India is supported by a regulatory environment that encourages the development and approval of new treatments. The Central Drugs Standard Control Organization (CDSCO) has streamlined the approval process for innovative therapies, which is likely to facilitate the entry of new anti-VEGF products into the market. This supportive regulatory framework not only fosters innovation but also enhances competition among pharmaceutical companies, potentially leading to more affordable treatment options for patients. As new therapies gain approval and enter the market, the anti vegf market is expected to expand, providing patients with a wider range of effective treatment choices for ocular diseases.