Growing Focus on Process Efficiency

The emphasis on process efficiency across various industries in India is driving the air operated-double-diaphragm-pumps market. Companies are increasingly seeking ways to optimize their operations, reduce downtime, and enhance productivity. Air operated-double-diaphragm pumps are recognized for their ability to provide consistent flow rates and handle a wide range of fluids, making them an attractive choice for industries aiming to improve their processes. This focus on efficiency is reflected in the growing adoption of automation and advanced technologies in manufacturing and processing plants. As organizations strive to streamline their operations, the air operated-double-diaphragm-pumps market is likely to see increased demand, as these pumps contribute to achieving higher operational efficiency.

Rising Demand in Manufacturing Sector

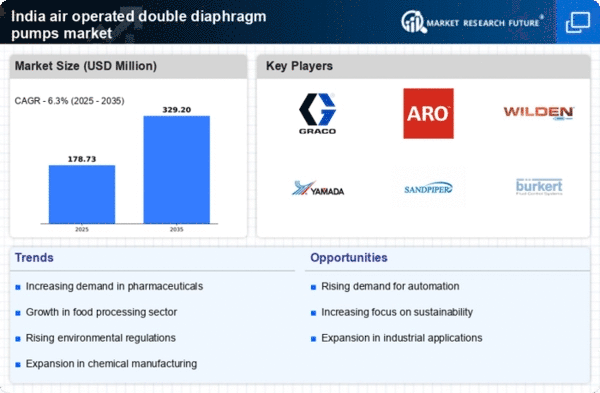

The manufacturing sector in India is experiencing a notable surge, which appears to be a significant driver for the air operated-double-diaphragm-pumps market. As industries such as chemicals, pharmaceuticals, and food processing expand, the need for efficient fluid transfer solutions increases. The air operated-double-diaphragm-pumps market is likely to benefit from this trend, as these pumps are known for their reliability and versatility in handling various fluids. According to recent data, the manufacturing sector is projected to grow at a CAGR of approximately 7.5% over the next few years, further fueling the demand for air operated-double-diaphragm pumps. This growth is expected to create opportunities for manufacturers and suppliers within the air operated-double-diaphragm-pumps market, as they cater to the evolving needs of the industry.

Increased Investment in Infrastructure

India's ongoing investment in infrastructure development is poised to significantly impact the air operated-double-diaphragm-pumps market. With government initiatives aimed at enhancing transportation, water supply, and sanitation, the demand for reliable pumping solutions is likely to rise. Air operated-double-diaphragm pumps are particularly suited for construction and civil engineering applications, where they can efficiently handle various materials, including slurries and viscous fluids. The Indian government has allocated substantial budgets for infrastructure projects, which could lead to an increase in the adoption of these pumps. As infrastructure projects expand, the air operated-double-diaphragm-pumps market may witness a corresponding growth, driven by the need for effective fluid management solutions.

Environmental Regulations and Compliance

The tightening of environmental regulations in India is influencing the air operated-double-diaphragm-pumps market. Industries are increasingly required to comply with stringent environmental standards, which necessitates the use of equipment that minimizes waste and emissions. Air operated-double-diaphragm pumps are often favored for their ability to handle hazardous materials safely and efficiently, aligning with regulatory requirements. As companies strive to meet compliance standards, the demand for these pumps is expected to rise. The air operated-double-diaphragm-pumps market may benefit from this trend, as manufacturers develop solutions that not only meet regulatory demands but also promote sustainability in operations.

Technological Innovations in Pump Design

Technological advancements in pump design are emerging as a key driver for the air operated-double-diaphragm-pumps market. Innovations such as improved materials, enhanced efficiency, and smart technology integration are transforming the capabilities of these pumps. Manufacturers are increasingly focusing on developing pumps that offer better performance, durability, and ease of maintenance. This trend is likely to attract a broader customer base, as industries seek reliable and efficient pumping solutions. The air operated-double-diaphragm-pumps market may experience growth as companies adopt these advanced technologies to enhance their operational capabilities and reduce costs.