Rising Demand for Energy

India's growing population and rapid urbanization are driving an unprecedented demand for energy, particularly in the oil and gas sector. According to the Ministry of Petroleum and Natural Gas, India's oil consumption is projected to reach 6 million barrels per day by 2025. This surge in demand necessitates the implementation of advanced connectivity solutions to optimize supply chains and enhance operational efficiency. The India Advanced Connectivity In The Oil And Gas Sector Market is poised to capitalize on this trend, as companies seek to leverage technology to meet the increasing energy needs. Enhanced connectivity can facilitate better monitoring of resources, predictive maintenance, and improved logistics, ultimately leading to a more resilient energy infrastructure that can support India's ambitious growth targets.

Technological Advancements

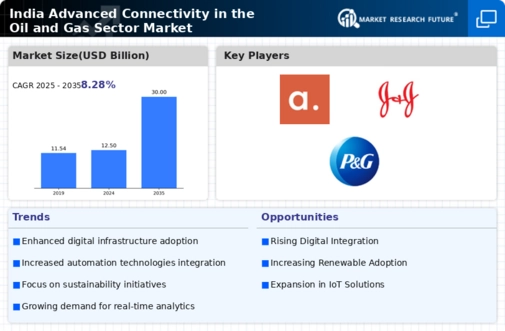

The rapid pace of technological advancements is a key driver for the India Advanced Connectivity In The Oil And Gas Sector Market. Innovations such as the Internet of Things (IoT), artificial intelligence (AI), and big data analytics are transforming how oil and gas companies operate. These technologies enable real-time monitoring of assets, predictive maintenance, and enhanced decision-making capabilities. For instance, the adoption of IoT devices in upstream operations can lead to significant cost savings and improved safety. As companies increasingly recognize the potential of these technologies, investments in advanced connectivity solutions are expected to rise. This trend is likely to foster a more efficient and responsive oil and gas sector, aligning with India's broader goals of energy security and sustainability.

Focus on Safety and Compliance

Safety and regulatory compliance remain paramount in the oil and gas sector, particularly in a country like India, where operational risks can be substantial. The implementation of advanced connectivity solutions is crucial for enhancing safety protocols and ensuring compliance with stringent regulations. Technologies such as remote monitoring and automated reporting systems can significantly reduce the risk of accidents and environmental hazards. The India Advanced Connectivity In The Oil And Gas Sector Market is likely to see increased investment in these solutions as companies strive to meet regulatory requirements while maintaining operational efficiency. Furthermore, the integration of advanced connectivity can facilitate better communication and coordination among stakeholders, thereby enhancing overall safety standards in the sector.

Government Initiatives and Policies

The Indian government has been actively promoting the adoption of advanced connectivity solutions in the oil and gas sector through various initiatives and policies. The Pradhan Mantri Ujjwala Yojana, for instance, aims to provide clean cooking fuel to millions, thereby increasing the demand for efficient supply chains. Additionally, the National Policy on Biofuels encourages the integration of advanced technologies in the oil and gas sector, which is expected to enhance operational efficiency. The India Advanced Connectivity In The Oil And Gas Sector Market is likely to benefit from these government-backed initiatives, as they create a conducive environment for investment and innovation. Furthermore, the government's focus on digital infrastructure development, including the rollout of 5G technology, is anticipated to facilitate real-time data exchange and improve connectivity across the sector.

Investment in Infrastructure Development

The Indian government and private sector are increasingly investing in infrastructure development to support the oil and gas industry. This includes the construction of pipelines, refineries, and storage facilities, all of which require advanced connectivity solutions for efficient operation. The India Advanced Connectivity In The Oil And Gas Sector Market stands to benefit from these investments, as enhanced connectivity can streamline operations and improve data management across the supply chain. For example, the development of smart pipelines equipped with sensors can provide real-time data on flow rates and pressure, enabling proactive maintenance and reducing downtime. As infrastructure projects continue to expand, the demand for advanced connectivity solutions is expected to grow, further driving the market.