Integration of 5G Technology

The advent of 5G technology is poised to revolutionize the Europe Advanced Connectivity In The Oil And Gas Sector Market. With its high-speed connectivity and low latency, 5G enables seamless communication between devices and systems, thereby enhancing operational capabilities. Oil and gas companies are increasingly investing in 5G infrastructure to support applications such as remote monitoring, predictive maintenance, and automated operations. The European Union has recognized the potential of 5G in this sector, with initiatives aimed at promoting its deployment. As a result, the market is expected to witness substantial growth, with projections indicating a potential increase in connectivity solutions by over 30% in the coming years.

Growing Demand for Real-Time Data Analytics

The Europe Advanced Connectivity In The Oil And Gas Sector Market is experiencing a notable shift towards real-time data analytics. This trend is driven by the need for enhanced operational efficiency and decision-making capabilities. Companies are increasingly leveraging advanced connectivity solutions to gather and analyze data from various sources, including sensors and IoT devices. According to recent estimates, the market for data analytics in the oil and gas sector in Europe is projected to reach approximately 5 billion euros by 2026. This growth is indicative of the industry's commitment to adopting innovative technologies that facilitate timely insights and improve overall productivity.

Collaboration and Partnerships for Innovation

Collaboration among stakeholders is emerging as a key driver in the Europe Advanced Connectivity In The Oil And Gas Sector Market. Companies are increasingly forming partnerships with technology providers, research institutions, and other industry players to foster innovation and accelerate the development of advanced connectivity solutions. These collaborations enable the sharing of knowledge, resources, and expertise, which can lead to the creation of more effective and efficient technologies. The European oil and gas sector has seen a rise in joint ventures focused on digital solutions, indicating a collective effort to enhance connectivity and operational performance. This trend is expected to continue, further propelling advancements in the market.

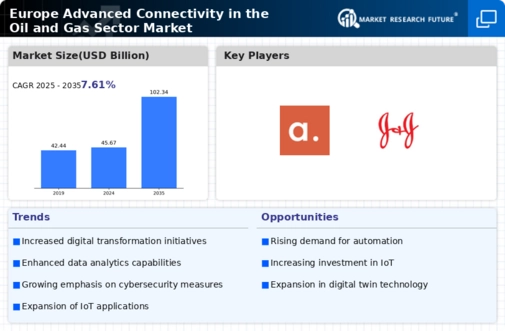

Increased Investment in Digital Transformation

The Europe Advanced Connectivity In The Oil And Gas Sector Market is witnessing a surge in investment aimed at digital transformation initiatives. Companies are recognizing the importance of integrating digital technologies to enhance operational efficiency and competitiveness. This investment trend is reflected in the growing allocation of budgets towards advanced connectivity solutions, including cloud computing, IoT, and big data analytics. Recent reports indicate that the digital transformation spending in the oil and gas sector in Europe is expected to exceed 10 billion euros by 2026. This influx of capital is likely to accelerate the adoption of innovative technologies that drive productivity and streamline operations.

Focus on Sustainability and Environmental Compliance

Sustainability has become a critical focus within the Europe Advanced Connectivity In The Oil And Gas Sector Market. Companies are under increasing pressure to comply with stringent environmental regulations and to adopt practices that minimize their ecological footprint. Advanced connectivity solutions facilitate better monitoring and reporting of emissions and resource usage, enabling firms to meet regulatory requirements more effectively. The European Commission has set ambitious targets for reducing greenhouse gas emissions, which has led to a surge in investments in technologies that support sustainable operations. This trend is likely to drive the adoption of advanced connectivity solutions, as firms seek to align with both regulatory expectations and public sentiment.