Expansion of Distribution Channels

The expansion of distribution channels is a key driver for the India AdBlue market. As the demand for AdBlue continues to rise, manufacturers are increasingly focusing on enhancing their distribution networks to ensure product availability across various regions. The establishment of partnerships with fuel stations and logistics companies facilitates easier access to AdBlue for consumers. As of January 2026, the market is experiencing a notable increase in the number of retail outlets offering AdBlue, which is expected to further boost sales. This strategic expansion not only enhances consumer convenience but also strengthens the overall infrastructure of the India AdBlue market.

Government Incentives and Subsidies

Government incentives and subsidies are crucial drivers for the India AdBlue market. The Indian government has introduced various financial incentives to encourage the adoption of cleaner technologies, including the use of AdBlue. These incentives may include tax rebates, subsidies for manufacturers, and support for infrastructure development related to AdBlue distribution. As of January 2026, such initiatives are expected to lower the overall cost of AdBlue for consumers, thereby increasing its market penetration. This supportive policy environment not only fosters growth in the India AdBlue market but also aligns with the country's broader goals of reducing pollution and promoting sustainable practices.

Regulatory Compliance and Emission Norms

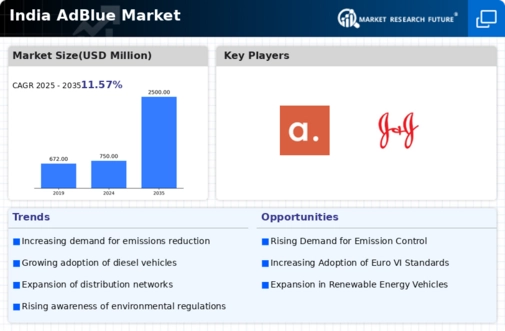

The India AdBlue market is significantly influenced by stringent regulatory compliance and emission norms. The Indian government has implemented various policies aimed at reducing vehicular emissions, particularly for diesel engines. The introduction of Bharat Stage VI (BS-VI) emission standards has necessitated the use of AdBlue, a urea-based solution that reduces nitrogen oxide emissions. As of January 2026, the market for AdBlue is projected to grow, driven by the increasing adoption of BS-VI compliant vehicles. This regulatory framework not only encourages manufacturers to produce cleaner vehicles but also stimulates demand for AdBlue, thereby enhancing the overall growth of the India AdBlue market.

Technological Advancements in Production

Technological advancements in the production of AdBlue are playing a pivotal role in shaping the India AdBlue market. Innovations in manufacturing processes have led to improved efficiency and cost-effectiveness in AdBlue production. For instance, the adoption of advanced purification techniques ensures higher quality and purity of the final product, which is crucial for optimal performance in vehicles. As of January 2026, the market is witnessing a surge in production capacity, with several manufacturers investing in state-of-the-art facilities. This trend not only meets the rising demand for AdBlue but also positions the India AdBlue market as a competitive player in the global market.

Growing Awareness of Environmental Issues

Growing awareness of environmental issues among consumers is significantly impacting the India AdBlue market. As public consciousness regarding air quality and environmental sustainability increases, there is a corresponding rise in the demand for cleaner fuel alternatives. AdBlue, known for its ability to reduce harmful emissions from diesel engines, is becoming a preferred choice for environmentally conscious consumers. As of January 2026, educational campaigns and government initiatives are further promoting the benefits of using AdBlue, thereby driving its adoption. This heightened awareness is likely to contribute to the sustained growth of the India AdBlue market.