Expansion of Smart Cities Initiatives

India's ambitious smart cities initiatives are significantly influencing the 5g system-integration market. The government aims to develop over 100 smart cities, which will rely heavily on advanced communication technologies, including 5G. These cities will utilize 5G for various applications such as traffic management, waste management, and public safety. The integration of 5G technology is expected to enhance the efficiency of urban services and improve the quality of life for residents. With an estimated investment of $1.5 billion in smart city projects, the demand for 5G system integration is likely to surge as cities seek to implement cutting-edge solutions. This trend indicates a robust growth trajectory for the 5g system-integration market in India.

Growing Focus on Digital Transformation

The growing focus on digital transformation across various sectors in India is a vital driver for the 5g system-integration market. Organizations are increasingly adopting digital technologies to enhance operational efficiency and customer engagement. The integration of 5G technology is seen as a catalyst for this transformation, enabling faster data processing and improved connectivity. As businesses invest in digital solutions, the demand for 5G system integration is likely to increase. Reports indicate that the digital transformation market in India could reach $500 billion by 2025, highlighting the potential for growth in the 5g system-integration market as companies seek to leverage advanced technologies to stay competitive.

Rising Demand for High-Speed Connectivity

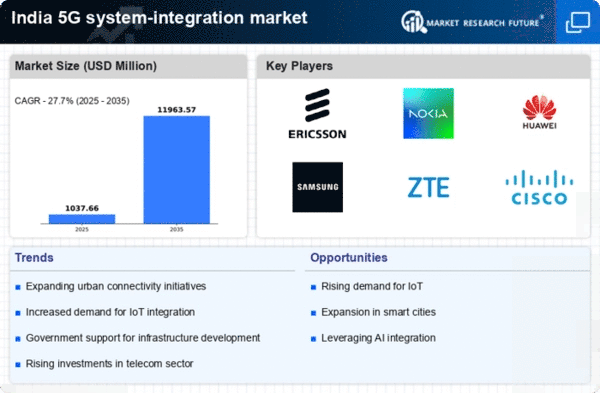

The increasing demand for high-speed connectivity in India is a primary driver for the 5g system-integration market. As businesses and consumers seek faster internet speeds for various applications, including streaming, gaming, and remote work, the need for robust 5G infrastructure becomes evident. According to recent estimates, the demand for high-speed internet is projected to grow by over 30% annually, necessitating significant investments in 5G system integration. This trend is further fueled by the proliferation of smart devices and the Internet of Things (IoT), which require seamless connectivity. Consequently, telecom operators and technology providers are focusing on enhancing their 5G capabilities, thereby driving the growth of the 5g system-integration market in India.

Emergence of Advanced Applications and Services

The emergence of advanced applications and services is propelling the growth of the 5g system-integration market in India. Industries such as healthcare, manufacturing, and entertainment are increasingly adopting 5G technology to leverage its low latency and high bandwidth capabilities. For instance, telemedicine and remote surgeries are becoming more feasible with 5G, while manufacturers are utilizing smart factories to enhance productivity. The market for 5G-enabled applications is expected to grow significantly, with projections indicating a potential increase of 25% in the next few years. This trend suggests that as more sectors recognize the benefits of 5G, the demand for system integration solutions will continue to rise.

Increased Investment in Telecommunications Infrastructure

The telecommunications sector in India is witnessing a surge in investments, which is a crucial driver for the 5g system-integration market. Major telecom operators are allocating substantial budgets to upgrade their infrastructure to support 5G technology. Reports suggest that investments in telecom infrastructure could reach $10 billion by 2026, as companies strive to enhance their service offerings and meet consumer expectations. This influx of capital is likely to accelerate the deployment of 5G networks, thereby creating a favorable environment for the growth of the 5g system-integration market. As operators expand their capabilities, the demand for integrated solutions that facilitate seamless connectivity will also increase.