Focus on Energy Efficiency

The growing emphasis on energy efficiency in India is a significant driver for the iot integration market. As industries and consumers become more conscious of energy consumption, there is a rising demand for IoT solutions that facilitate monitoring and management of energy usage. The Indian government has set ambitious targets to reduce energy intensity by 33-35% by 2030, which necessitates the integration of smart technologies. This focus on sustainability is likely to propel the iot integration market, as businesses seek to implement solutions that optimize energy consumption and reduce operational costs, thereby aligning with national energy goals.

Growth in Connected Devices

The proliferation of connected devices in India is significantly influencing the iot integration market. With an estimated 1.5 billion connected devices expected by 2025, the need for effective integration solutions becomes paramount. This surge in connectivity is driven by the increasing adoption of smartphones, wearables, and smart home devices. As consumers and businesses alike embrace these technologies, the iot integration market must adapt to ensure seamless communication and interoperability among diverse devices. This trend not only enhances user experience but also opens new avenues for service providers to offer integrated solutions that cater to the evolving demands of the market.

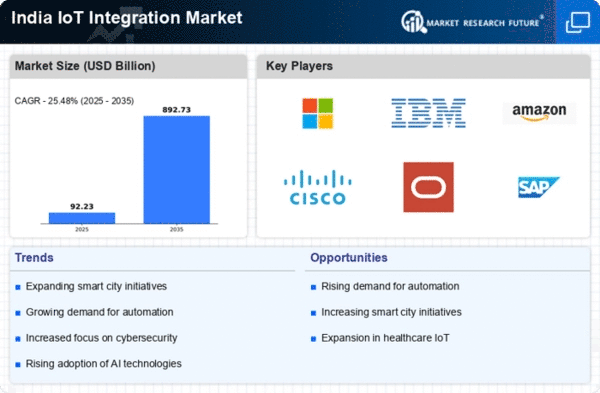

Rising Demand for Automation

The increasing demand for automation across various sectors in India is a pivotal driver for the iot integration market. Industries such as manufacturing, agriculture, and healthcare are actively seeking to enhance operational efficiency through automated solutions. According to recent estimates, the automation market in India is projected to grow at a CAGR of approximately 10% over the next five years. This trend indicates a robust appetite for IoT solutions that facilitate seamless integration of devices and systems. As businesses strive to optimize processes and reduce costs, the The iot integration market is likely to experience significant growth. This growth is driven by the need for interconnected devices that can communicate and operate autonomously.

Expansion of Smart Cities Initiatives

India's ambitious smart cities initiative is a crucial catalyst for the iot integration market. With the government aiming to develop 100 smart cities, there is a substantial push for integrating IoT technologies into urban infrastructure. This initiative is expected to attract investments exceeding $30 billion over the next decade. The integration of IoT solutions in areas such as traffic management, waste management, and energy efficiency is essential for the success of these smart cities. Consequently, the iot integration market is poised to benefit from the demand for innovative solutions that enhance urban living and sustainability, thereby creating a conducive environment for growth.

Advancements in Telecommunications Infrastructure

The rapid advancements in telecommunications infrastructure in India are fostering growth in the iot integration market. The rollout of 5G technology is expected to enhance connectivity and enable faster data transmission, which is crucial for IoT applications. With the government investing heavily in expanding broadband access, the potential for IoT solutions to thrive increases significantly. Enhanced connectivity will facilitate the deployment of more sophisticated IoT systems across various sectors, including healthcare, transportation, and agriculture. As a result, the iot integration market is likely to benefit from improved infrastructure, enabling more robust and reliable IoT applications.