Rising Demand for Biopharmaceuticals

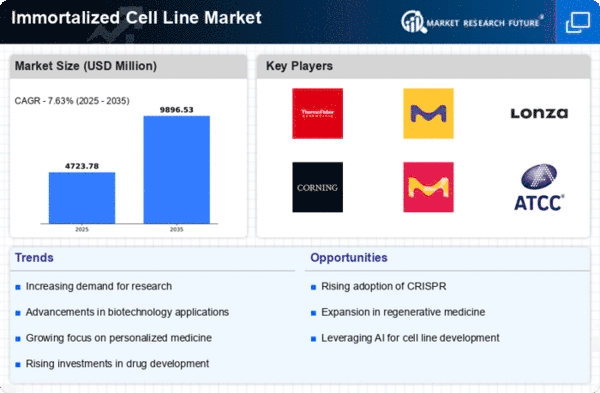

The increasing demand for biopharmaceuticals is a primary driver of the Global Immortalized Cell Line Market Industry. As the biopharmaceutical sector expands, the need for reliable and consistent cell lines for drug development and production intensifies. Immortalized cell lines provide a stable and reproducible platform for research and manufacturing, which is crucial for the development of therapeutic proteins and monoclonal antibodies. In 2024, the market is projected to reach 4.51 USD Billion, reflecting the growing reliance on these cell lines in biopharmaceutical applications. This trend is likely to continue as the industry evolves, potentially leading to a market size of 9.18 USD Billion by 2035.

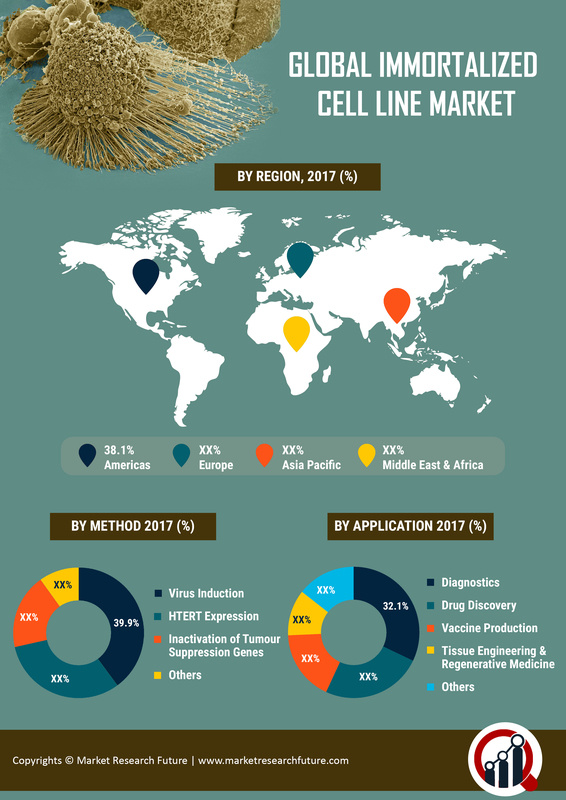

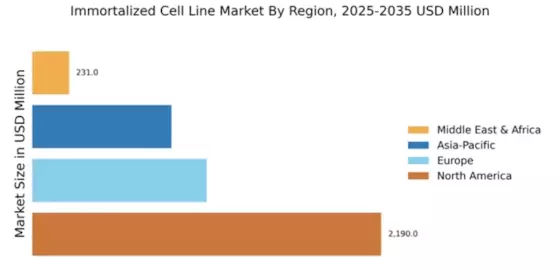

Emerging Markets and Global Expansion

Emerging markets are becoming increasingly important in the Global Immortalized Cell Line Market Industry. Countries in Asia-Pacific and Latin America are witnessing rapid growth in their biopharmaceutical sectors, driven by rising healthcare expenditures and increasing research activities. This expansion presents significant opportunities for the adoption of immortalized cell lines in these regions. As global players seek to establish a presence in these markets, the demand for reliable cell lines is expected to surge. This trend is likely to contribute to the overall growth of the market, as companies adapt their strategies to cater to the unique needs of emerging economies.

Advancements in Cell Line Technologies

Technological advancements in cell line development are significantly influencing the Global Immortalized Cell Line Market Industry. Innovations such as CRISPR-Cas9 gene editing and improved culture techniques enhance the efficiency and reliability of immortalized cell lines. These advancements enable researchers to create cell lines with specific genetic modifications, facilitating targeted drug discovery and personalized medicine approaches. As these technologies become more accessible, the market is expected to grow at a CAGR of 6.67% from 2025 to 2035. This growth is indicative of the increasing integration of advanced technologies in cell line research and development.

Growing Focus on Personalized Medicine

The shift towards personalized medicine is reshaping the Global Immortalized Cell Line Market Industry. Immortalized cell lines play a crucial role in understanding individual responses to therapies, allowing for the development of tailored treatment strategies. This focus on personalized approaches is driving research and development efforts, as pharmaceutical companies seek to create more effective and targeted therapies. The market's growth is supported by the increasing investment in personalized medicine initiatives, which is expected to further propel the demand for immortalized cell lines in the coming years. As a result, the industry is poised for substantial growth as it aligns with evolving healthcare paradigms.

Regulatory Support for Cell Line Research

Regulatory bodies are increasingly recognizing the importance of immortalized cell lines in research and development, providing a favorable environment for the Global Immortalized Cell Line Market Industry. Guidelines and frameworks established by organizations such as the FDA and EMA facilitate the use of these cell lines in drug development and testing. This regulatory support not only ensures the safety and efficacy of biopharmaceutical products but also encourages investment in cell line research. As regulations evolve to accommodate advancements in cell line technology, the market is likely to experience sustained growth, further solidifying the role of immortalized cell lines in the biopharmaceutical landscape.