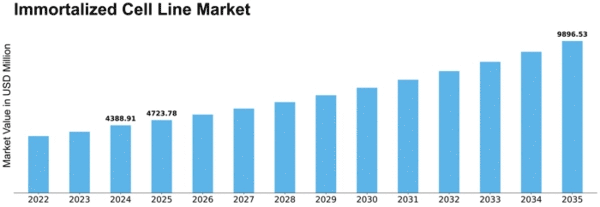

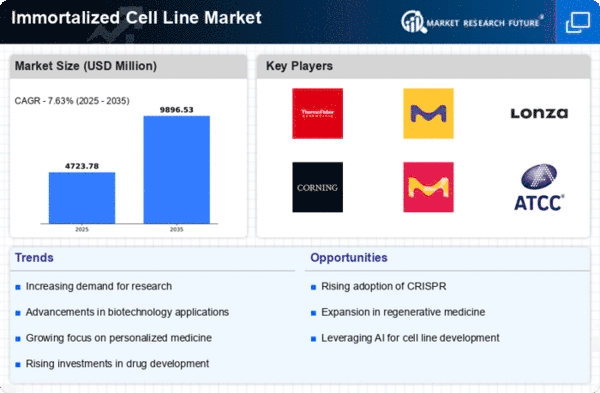

Immortalized Cell Line Size

Immortalized Cell Line Market Growth Projections and Opportunities

Immortalized cell lines play a pivotal role in the realm of cell biology, contributing significantly to the study of multicellular organisms and their biochemistry. These cell lines, characterized by cells that continuously divide without stopping or those manipulated to proliferate indefinitely, offer the advantage of being cultured over multiple generations. In the context of human hepatic cell lines, HepaRG and Hep G2 stand out as frequently utilized options for toxicity studies. The increasing demand for immortalized cell lines is accompanied by a broadening array of applications, with a notable surge in adoption observed in stem cell therapy. Factors fueling this growth include heightened awareness regarding the utilization of cell lines in healthcare, expanding vaccine production, the growing application of cell lines in cancer therapy, and the integration of innovative technologies for cell line research. Despite these positive trends, challenges such as the high cost of equipment and the complexities associated with developing stable and authentic strains pose hindrances to the market's overall expansion.

As of 2017, the global immortalized cell line market was valued at USD 2,421.34 million, with projections indicating an anticipated rise to USD 4,105.62 million by 2023, reflecting a Compound Annual Growth Rate (CAGR) of 9.30% during the forecast period from 2018 to 2023. The Americas led the market in 2017, holding a share of 38.1%, followed by Europe with a share of 32.6%.

Examining the methods employed in immortalizing cell lines, virus induction claimed the largest market share at 39.9% in 2017. This technique's prominence is driven by its association with cancer research and the heightened demand for innovative drug discovery. The hTERT expression segment is expected to witness the highest CAGR of 9.94% during the forecast period.

Regarding applications, diagnostics represented the largest market share at 32.1% in 2017, with the increasing prevalence of chronic diseases like cancer and autoimmune disorders driving demand for rapid and effective therapeutics. The vaccine production segment is projected to experience the highest CAGR of 9.87% during the forecast period.

In terms of end-users, pharmaceutical and biopharmaceutical companies accounted for the largest market share at 54.7% in 2017. This dominance is attributed to growing awareness of monoclonal antibodies' application in cancer treatment and supportive government initiatives. The Contract Research Organization (CRO) segment is expected to witness the highest CAGR of 10.01% during the forecast period.

Regionally, the Americas maintained the largest market share at 38.1% in 2017, driven by continuous technological advancements and discoveries fostering the adoption of new bioproduction procedures. Europe is anticipated to exhibit the highest CAGR of 32.6% during the forecast period from 2018 to 2023.

Leave a Comment