Growing Regulatory Support for Hydrogen Adoption

The Hydrogen Pipeline Market is significantly influenced by the growing regulatory support aimed at promoting hydrogen adoption. Various governments are implementing policies and regulations that encourage the development of hydrogen infrastructure. For instance, initiatives such as tax incentives and grants for hydrogen projects are becoming more prevalent. These regulatory frameworks are designed to reduce the financial burden on companies investing in hydrogen pipelines, thereby accelerating market growth. Furthermore, the establishment of safety standards and operational guidelines enhances the credibility of hydrogen as a viable energy source. As regulatory support continues to strengthen, it is expected that the Hydrogen Pipeline Market will experience substantial growth, driven by increased confidence among investors and stakeholders.

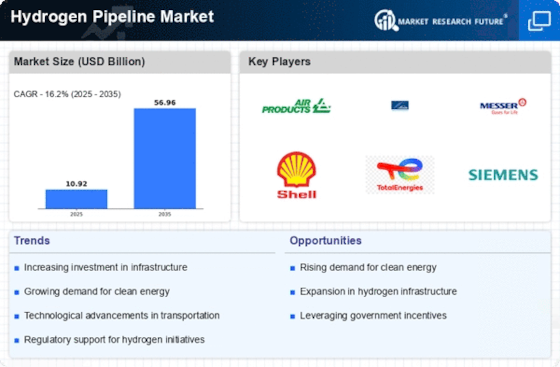

Increasing Investment in Hydrogen Infrastructure

The Hydrogen Pipeline Market is witnessing a surge in investment as governments and private entities recognize the potential of hydrogen as a clean energy source. In recent years, funding for hydrogen infrastructure has escalated, with estimates suggesting that investments could reach over 70 billion dollars by 2030. This influx of capital is likely to enhance the development of hydrogen pipelines, facilitating the transportation of hydrogen from production sites to end-users. The establishment of robust infrastructure is essential for the growth of the hydrogen economy, as it enables efficient distribution and utilization of hydrogen. Consequently, the increasing investment in hydrogen infrastructure is a pivotal driver for the Hydrogen Pipeline Market, fostering advancements in technology and operational efficiency.

Technological Advancements in Hydrogen Transport

The Hydrogen Pipeline Market is benefiting from technological advancements that enhance the efficiency and safety of hydrogen transport. Innovations in pipeline materials and construction techniques are making it possible to transport hydrogen over longer distances with reduced risk of leakage and degradation. For example, the development of advanced composite materials is enabling the construction of lighter and more durable pipelines. Additionally, improvements in monitoring and control systems are enhancing the operational safety of hydrogen transport. These technological advancements not only improve the reliability of hydrogen pipelines but also reduce operational costs, making hydrogen a more attractive option for energy transport. As these technologies continue to evolve, they are expected to play a vital role in the growth of the Hydrogen Pipeline Market.

Emerging Hydrogen Economy and Market Opportunities

The Hydrogen Pipeline Market is poised for growth due to the emergence of a hydrogen economy, which presents numerous market opportunities. As countries aim to achieve carbon neutrality, hydrogen is increasingly viewed as a key component of future energy systems. The establishment of hydrogen hubs and networks is likely to create new business models and partnerships, facilitating the development of hydrogen pipelines. Market analysts project that the hydrogen economy could generate trillions of dollars in economic activity by 2050. This potential for economic growth is attracting investments and fostering innovation within the Hydrogen Pipeline Market. As stakeholders recognize the opportunities presented by the hydrogen economy, the demand for hydrogen pipelines is expected to rise, further driving market expansion.

Rising Demand for Hydrogen in Industrial Applications

The Hydrogen Pipeline Market is propelled by the rising demand for hydrogen in various industrial applications. Industries such as refining, ammonia production, and steel manufacturing are increasingly utilizing hydrogen as a cleaner alternative to traditional fossil fuels. Reports indicate that the demand for hydrogen in these sectors could grow by over 30% in the next decade. This shift towards hydrogen is primarily driven by the need to reduce carbon emissions and comply with stringent environmental regulations. As industries seek to transition to more sustainable practices, the demand for hydrogen pipelines to facilitate the transportation of hydrogen will likely increase. Thus, the growing industrial demand for hydrogen serves as a crucial driver for the Hydrogen Pipeline Market.